Advertiser Disclosure

Crediful is committed to helping you make smarter financial decisions by presenting you with the best information possible. We are able to present this information to you free of charge because some of the companies featured on our site compensate us.

Compensation may impact how and where products appear on this site, including the order in which they may appear within listing categories.

While Crediful does not feature every company, financial product, or offer available, we are proud that the information, reviews, guides, and other tools found on our site are entirely objective and available to you free of charge.

Our #1 priority is you, our reader. We will never ever recommend a product or service that we wouldn’t use ourselves. Our reviews are based on independent research.

What does this mean for you? It’s simple: we will never steer you in the wrong direction just because a company offers to pay us.

Credit Inquiry Removal Letter for 2024

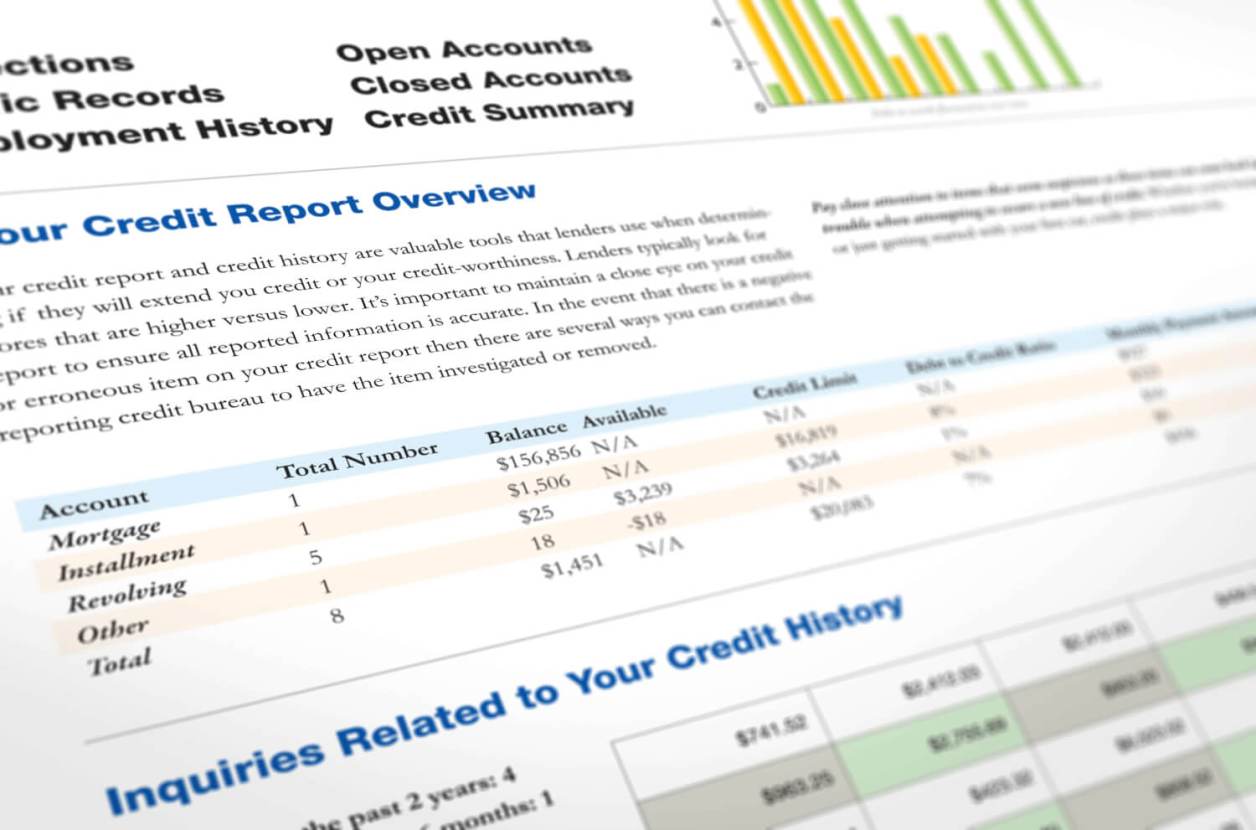

If you’ve recently received copies of your credit report, you may have noticed an ‘Inquiries’ section towards the bottom of the report.

In most cases, this section has minimal impact on your credit score. But the way you manage your credit, particularly the way you apply for credit, can end up making a big difference if not facilitated correctly.

Learning about credit inquiries can also help you spot any potential credit fraud. For example, if you have hard inquiries on your credit report that you’re sure you didn’t make, it could be a sign of identity theft.

Read on to find out everything you need to know about what credit inquiries are, how they affect you, and how to get rid of them.

What is a credit inquiry removal letter?

A credit inquiry removal letter is used to dispute an unauthorized inquiry. It is sent to the credit bureaus to request that a credit inquiry be removed. After receiving your letter, the credit bureaus are obligated to investigate your claim with the creditor who placed the hard inquiry on your credit report.

Under the Fair Credit Reporting Act, the information provider has 30 days to report back to the credit bureau with proof that you authorized the credit inquiry. If they fail to respond or provide proof, the credit inquiry must be removed from your credit report.

Credit inquiries don’t have a major impact on your credit score. However, if you have too many in a short period of time, they can definitely damage your credit history. That’s why it’s important to have unauthorized credit inquiries removed from your credit report.

How to Write a Credit Inquiry Removal Letter

Sometimes companies and individuals make hard inquiries that you did not authorize. In those cases, there is a way to remove the hard inquiry and improve your credit scores as a result. It’s called a “credit inquiry removal letter” or a “credit inquiry dispute letter.”

You can dispute a hard credit inquiry even if it’s “questionable” and you’re uncertain whether you made it or not. The burden of proof is on the credit reporting agency and your creditor.

We have prepared a sample letter to send to the credit bureaus requesting an investigation of an unauthorized inquiry appearing on your credit report.

Credit Inquiry Removal Letter Template

Be sure to send via certified mail rather than standard mail delivery to get a faster response and ensure your letter is received.

Try to make the letter appear more personal than this form letter, but make sure to use your own words. Remember, this is just an example. Your letter should look similar to this:

{Name}

{Address}

{Phone #}

{Credit Bureau: Name}

{Credit Bureau: Address}

{Date}

RE: Request for Investigation of Unauthorized Credit Inquiry

Dear Sir or Madam,

I checked my personal credit report, which I acquired from your organization on {insert date of report} and I noticed an unauthorized credit inquiry had been made.

I contacted {inquiry source’s name}, who conducted the inquiry and asked them to remove their credit inquiry from my credit report.

I request that you investigate the [inquiry source’s name] inquiry on my credit report to determine who authorized the inquiry. If you find my allegation to be true once your investigation is complete, please remove the inquiry and send me an updated copy of my credit report at the address listed above.

If you find the inquiry referenced above to be valid, please send me a description of the procedures used in your investigation within 15 business days of completing the investigation.

Thank you for your assistance in this matter,

{Signature}

{Printed Name}

What should I include with my letter?

Be sure to include a copy of the credit report page evidencing the credit inquiry. It also doesn’t hurt to highlight the section, just so there’s no mistake.

Otherwise, you run the risk of delaying the process and adding additional communications. Take the extra step ahead of time to save potential complications further down the road.

Furthermore, each of the three credit bureaus may have additional requirements when it comes to supporting documentation. This can include things like proof of identification, your Social Security number, proof of residence and so on.

Online Credit Inquiry Dispute

All three major credit bureaus also allow you to file a dispute against a hard inquiry online. Conducting an online dispute can help you save time, plus it’s usually much more convenient. While we typically don’t recommend disputing online, it may be a suitable option if you’re pressed for time.

To initiate a credit inquiry dispute, you need to create an online account with each credit bureau. From there you can upload relevant documents as well as check on the status of your dispute as things progress.

Once you’ve created an account, you can submit your documentation and file a credit inquiry dispute. The credit bureau will then review all the information, ask you for any further documentation as needed, and communicate with the creditor to obtain further information.

You’ll find all the relevant details at each of the three major credit bureaus’ websites.

What’s the difference between hard inquiries and soft inquiries?

Each time a bank, lender, credit card issuer, or insurance company receives an application from you, an inquiry is placed on your credit report. They have been authorized by you and are called “hard inquiries.”

Unsolicited credit card offers that come in the mail are called “soft inquiries.” Credit card issuers, insurance companies, and lenders make those inquiries. You did not make them, so they don’t impact your credit score, even though they appear on your credit report.

Pre-approvals and pre-qualifications initiated on your own usually also only constitute a soft inquiry. However, to be sure, check with the creditor before agreeing to one.

See also: Hard vs. Soft Inquiries: How They Affect Your Credit Score

How do credit inquiries impact my credit score?

Hard credit inquiries affect your credit score at different times and in different ways. For example, when you’re shopping for a loan, you might apply for new credit from various banks or credit unions.

They all check your credit, and by signing the application, you authorize them to do so. Credit scorers understand this is simply a consumer out shopping for the best rate they can get.

They allow for this activity and don’t deduct points for each individual hard inquiry when this occurs. Instead, as long as the credit inquiries are all made within a 45-day window, they group them together and count them as one inquiry.

But if you take too long and shop around, the resulting credit inquiries can impact your score negatively.

How long do inquiries stay on my credit report?

All hard credit inquiries are listed on your credit report for two years. After that, they should fall off naturally. On the plus side, an inquiry only impacts your credit score for one year. Once that period is up, your score should rebound a few points.

Again, it’s no big deal if you just have a few hard inquiries listed on your credit report. But if you have a long list of them, you might want to try getting one or more of the inquiries removed.

This is especially true if you don’t remember authorizing the inquiry. To dispute a hard credit inquiry, you must contact each credit bureau that lists it.

Focus Your Credit Repair Efforts on More Serious Items

While having too many credit inquiries can hurt your credit score, they are the smallest scoring factor. In fact, each hard inquiry typically deducts about five points from your credit score.

We find that most people spend too much time worrying about credit inquiries. They usually have worse negative items on their credit report that have a much bigger impact on their credit score.

But if you apply for credit cards every month, either out of necessity or as a rewards bonus hack, you can really start to cause some damage.

Do you have other negative information affecting your credit?

Do you have other negative marks on your credit reports? Or maybe you don’t want to bother disputing inquiries on your own? If so, you can retain a credit repair company that can do the work more efficiently and effectively for you.

A professional credit repair firm performs these tasks hundreds of times a day. However, when investigating credit repair companies, be sure to look for a firm with many years of experience and satisfied clients.

Read our Credit Saint Review for more information, or visit their website for a free consultation to find out how they can help you.

Ready to Raise Your Credit Score?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.

How to Deal With Potential Identity Theft

While some hard credit inquiries can appear in your credit report due to a clerical error, it is also possible that someone else has authorized an inquiry in your name. This means you are likely to be a victim of identity theft. If you suspect this is the case, you’ll want to move fast and make a complaint to the Federal Trade Commission.

Check out the steps below:

1. Make a Report Online

If you suspect an unauthorized inquiry could be the result of identity theft, check out identitytheft.gov. Here you can submit a report by providing all the information you have. In return, you’ll be provided with relevant resources, and a personalized recovery plan.

2. Follow Your Recovery Plan

While recovery plans will differ from case to case, generally you’ll have to provide proof of identity and evidence that strengthens your claim. You’ll also be asked to provide any examples of when and where the suspected theft occurred.

If you do contact the Federal Trade Commission, they will provide instructions on progressing with your case. You’ll need to follow the progress and adhere to the requirements to complete your identity theft complaint.

If your case is a complex one, there may be a lot of paperwork required between you and the FTC. The good news is that you can easily track progress of your case online.

3. Consider Further Action

While you wait for your case to be processed, there are further steps you can take to protect your identity in the future.

For example, you may choose to file an official police report, as well as put a freeze on your credit to prevent further credit inquiries. In most cases, you can initiate a credit freeze online to last anywhere from 90 days to several years.

Final Word

Unauthorized inquiries can damage your credit history, especially if there are several hard inquiries made in a short period.

The good news is that initiating disputes with credit bureaus is a simple process. You can file a dispute by mail or online for free, and most cases will be solved within 30 days.