Is 646 a good credit score?

The FICO score range, which ranges from 300 to 850, is widely used by lenders and financial institutions as a measure of creditworthiness. As you can see below, a 646 credit score is considered Fair. For context, the average credit score in America is 718.

| Credit Score | Credit Rating | % of population[1] |

| 300 – 579 | Poor | 16% |

| 580 – 669 | Fair | 17% |

| 670 – 739 | Good | 21% |

| 740 – 799 | Very Good | 25% |

| 800 – 850 | Exceptional | 21% |

646 Credit Score Credit Card & Loan Options

Some lenders choose not to lend to borrowers with Fair credit scores. As a result, your financing options will be somewhat limited. With a score of 646, your focus should be on building your credit history and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

Can you get a credit card with a 646 credit score?

Credit card applicants with a credit score in this range may be required to put down a security deposit. Applying for a secured credit card is probably your best option. However, credit card issuers often require a security deposit of $500 – $1,000. You may also be able to get a “starter” credit card from a credit union. It’s an unsecured credit card, but it comes with a low credit limit and high interest rate.

If you are able to get approved for a credit card, you must make your monthly payments on time and keep your balance below 30% of your credit limit.

See also: 6 Best Secured Credit Cards

Can you get a personal loan with a credit score of 646?

Very few personal loan lenders will approve you for a personal loan with a 646 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

It’s best to avoid payday loans and high-interest personal loans, as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a credit builder loan may be a suitable option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

See also: 7 Best Personal Loans for Bad Credit

Can I get a home loan with a credit score of 646?

The minimum credit score required by most conventional mortgage lenders is around 620.

However, for those interested in applying for an FHA loan, applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10%. Those with a credit score of 580 can qualify for a down payment as low as 3.5%.

See also: 9 Best Mortgage Loans for Bad Credit

Can I get an auto loan with a 646 credit score?

Some auto lenders will not lend to someone with a 646 score. If you manage to get approved for a car loan with a 646 score, it could be expensive. If you can raise your credit score, getting a car will be much easier.

See also: 5 Best Auto Loans for Bad Credit

How to Improve a 646 Credit Score

A Fair credit score often indicates a history of credit mistakes or errors. For example, you may have some late or missed payments, charges offs, foreclosures, and even bankruptcies showing up on your credit report.

Here are five ways to improve your 646 credit score:

1. Dispute Negative Accounts on Your Credit Report

It’s a good idea to grab a copy of your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Credit Saint. They can help you dispute them and possibly have them removed.

They specialize in removing inaccurate negative items from your credit report. With over 15 years of experience, they have a proven track record of removing incorrect entries for many clients.

They can help you with the following items:

- hard inquiries

- late payments

- collections

- charge offs

- foreclosures

- repossessions

- judgments

- liens

- bankruptcies

2. Take Out a Credit Builder Loan

Credit builder loans are installment loans that are specifically designed to help people with poor credit build or rebuild credit history. In fact, credit builder loans do not require a credit check at all. Plus, it’s probably the cheapest and easiest way to boost your credit scores.

With credit builder loans, the money sits in a savings account until you’ve completed all your monthly payments. The loan payments are reported to at least one credit bureau, which gives your credit scores a boost.

See also: 5 Best Credit Builder Loans

3. Get a Secured Credit Card

Getting a secured credit card is a great way to establish credit. Secured credit cards work much the same as unsecured credit cards. The only difference is they require a security deposit that also acts as your credit limit. The credit card issuer will keep your deposit if you stop making the minimum payment or can’t pay your credit card balance.

4. Become an Authorized User

If you are close to someone who has excellent credit, becoming an authorized user on their credit account, is the fastest way to raise your credit scores. Their account information gets added to your credit report, which will raise your credit scores immediately.

5. Build Credit by Paying Your Rent

Unfortunately, rent and utility payments aren’t usually reported to the three credit bureaus. However, for a small fee, rent reporting services will add your payments to your credit report, which will help you improve your credit scores.

Where to Go from Here

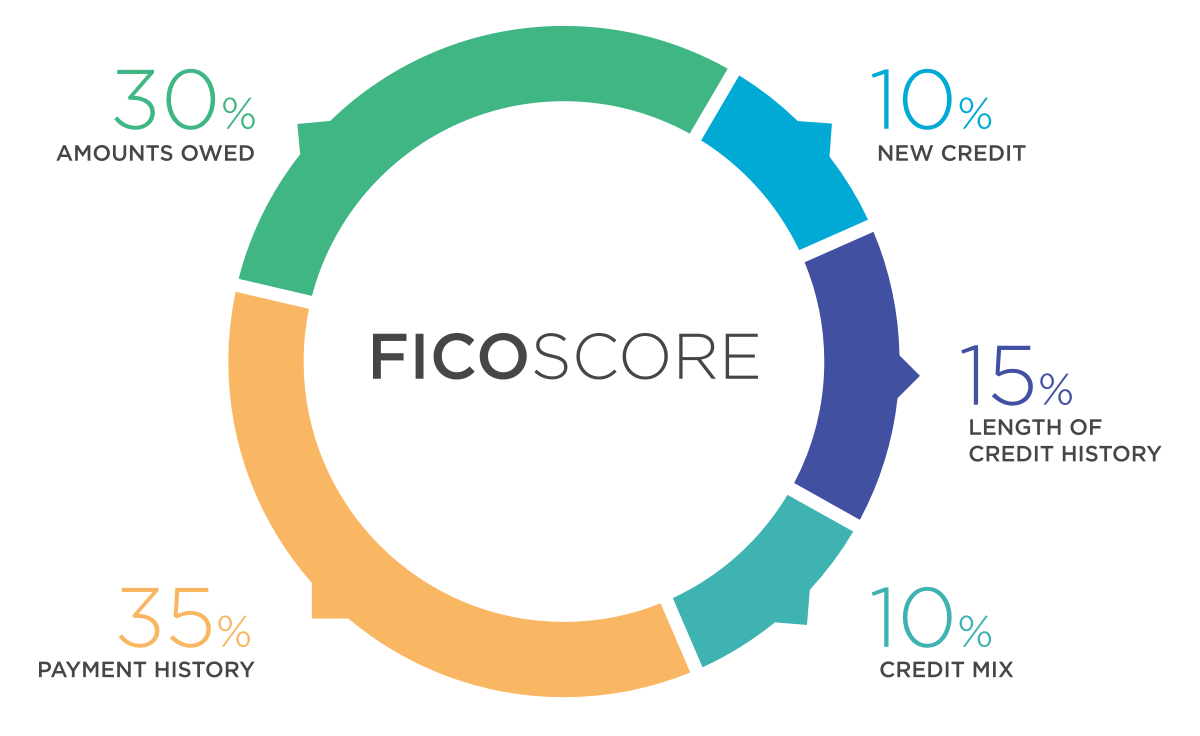

It’s important to know which factors make up your credit score. As outlined in the image below, there are 5 factors that make up your credit score.

Pay down your balances and keep your credit utilization under 30%. It’s also wise to have different types of credit accounts to establish a solid credit mix because it accounts for up to 10% of your FICO score. So, you’ll want to have both installment and revolving credit showing up on your credit reports.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Building good credit doesn’t happen overnight, but you can definitely accelerate the process by making the right moves. So, visit Credit Saint or call (855) 281-1510 for a free credit consultation and get started repairing your credit today! The sooner you start, the sooner you’ll be on your way to having good credit.

Crediful is your go-to destination for all things related to personal finance. We're dedicated to helping you achieve financial freedom and make informed financial decisions. Our team of financial experts and enthusiasts brings you articles and resources on topics like budgeting, credit, saving, investing, and more.