Is 792 a good credit score?

The FICO score range, which ranges from 300 to 850, is widely used by lenders and financial institutions as a measure of creditworthiness. As you can see below, a 792 credit score is considered Very Good. For context, the average credit score in America is 718.

| Credit Score | Credit Rating | % of population[1] |

| 300 – 579 | Poor | 16% |

| 580 – 669 | Fair | 17% |

| 670 – 739 | Good | 21% |

| 740 – 799 | Very Good | 25% |

| 800 – 850 | Exceptional | 21% |

792 Credit Score Credit Card & Loan Options

Borrowers with credit scores in the Very Good range should have no issues qualifying for a loan or credit card. With a credit score of 792, your focus should be maintaining your credit status to make sure you continue to get the most favorable loan terms available.

Can you get a credit card with a 792 credit score?

Credit card applicants with a credit score in this range will be approved for most credit cards. Remember to always make your monthly payments on time and keep your balance below 30% of your credit limit.

Can you get a personal loan with a credit score of 792?

Most personal loan lenders will approve you for a loan with a 792 credit score. In fact, you will likely qualify for the best loan rates available. However, keep in mind that your credit score is just one factor that lenders consider when deciding whether to approve your loan application. Other factors, such as your income, debt-to-income ratio, and employment history, may also come into play.

See also: 9 Best Personal Loans for Good Credit

Can I get a home loan with a credit score of 792?

The minimum credit score is around 620 for most conventional lenders, so you should qualify with no issues. With a higher credit score, you can expect the best interest rates and loan terms. This can save you thousands of dollars over the life of the loan.

See also: 10 Best Mortgage Lenders for Good Credit

Can I get an auto loan with a 792 credit score?

Most auto lenders will lend to someone with a 792 score. With Very Good credit scores, you should qualify for the best interest rates they have to offer. However, lenders also look at other factors, so there’s no guarantee that you’ll be approved for a loan.

See also: 10 Best Auto Loans for Good Credit

How to Improve a 792 Credit Score

Having a credit score in the Very Good range generally indicates a history of prompt bill payments, but there might be some late payments or charge-offs still reported. To boost that 792 credit score, follow these expert tips:

Analyze Your Credit Reports

Begin by requesting a free copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Carefully review each credit report to identify any negative items that could be impacting your credit scores.

Consider Credit Repair Assistance

If your credit reports contain negative items, think about enlisting the help of a credit repair company like Credit Saint. Their team of experts can assist you in disputing these items and potentially have them removed.

With over 15 years of experience, they have a proven track record of removing incorrect entries for many clients. Their expertise covers a wide range of issues, including:

- Hard inquiries

- Late payments

- Collections

- Charge-offs

- Foreclosures

- Repossessions

- Judgments

- Liens

- Bankruptcies

To receive a free credit consultation, visit Credit Saint or call (855) 281-1510 and get started on your credit repair journey. The sooner you start, the faster you’ll be on track to achieving excellent credit.

Strategize for Future Success

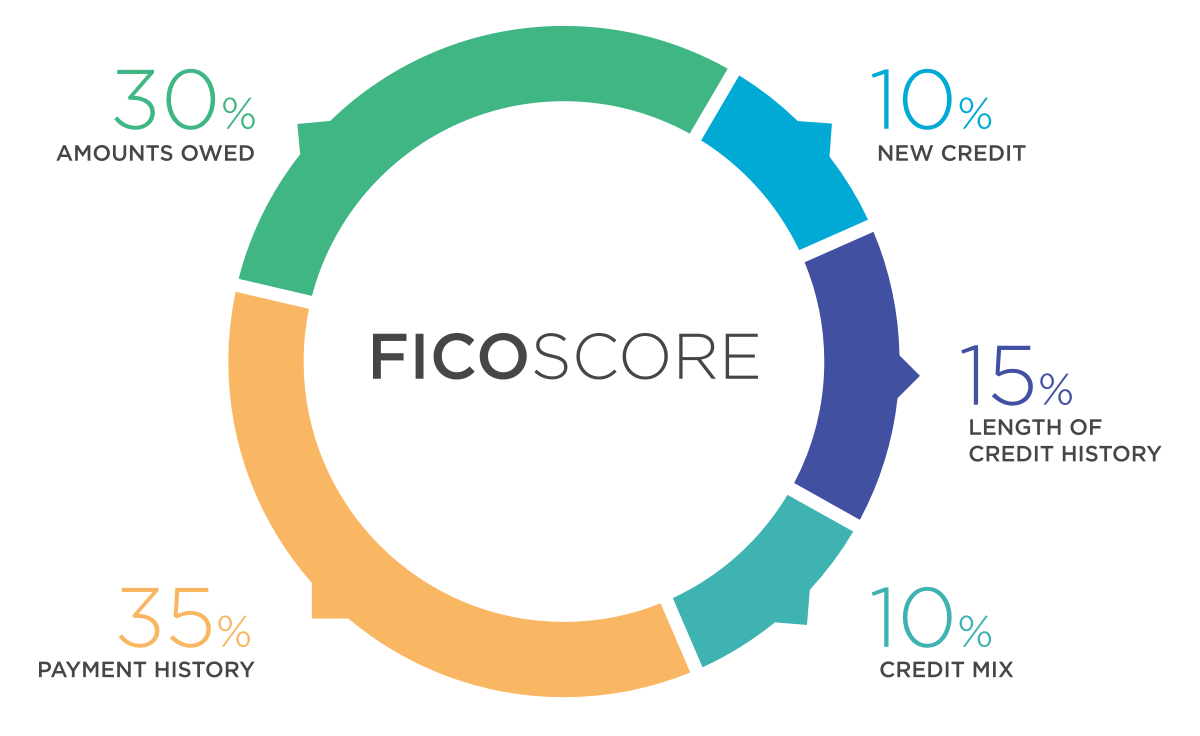

Understanding the five factors that contribute to your FICO credit score is essential for achieving and maintaining an excellent credit score. Here’s a breakdown of each factor and how to manage it effectively:

Payment History (35% of your FICO score)

Timely payments are the most critical component of your credit score. Late or missed payments can severely damage your score, so be sure to set reminders, automate payments, or create a budget to ensure you’re consistently paying on time.

Credit Utilization (30% of your FICO score)

Credit utilization refers to the percentage of available credit you’re currently using. To maintain a healthy credit score, aim to keep your credit utilization ratio below 30%. This means that if you have a $10,000 credit limit, you should avoid carrying a balance of more than $3,000 at any given time. To achieve this, pay off balances regularly, keep credit card spending in check, and monitor your credit usage.

Length of Credit History (15% of your FICO score)

The longer your credit history, the better it is for your credit score. Lenders view a long, positive payment history as an indicator of financial stability and trustworthiness. To maximize this factor, avoid closing your oldest accounts, even if you don’t use them regularly. Instead, keep them open and use them occasionally for small purchases to maintain a favorable credit history.

Credit Mix (10% of your FICO score)

Having a diverse mix of credit accounts showcases your ability to manage different types of credit responsibly. Aim for a balanced mix of revolving credit (e.g., credit cards) and installment loans (e.g., car loans, mortgages, or student loans). While it’s not necessary to open new accounts solely for the sake of diversification, it’s essential to demonstrate responsible behavior across various credit lines.

New Credit (10% of your FICO score)

Opening multiple new credit accounts within a short period can negatively impact your credit score, as it may signal financial risk to potential lenders. To maintain a strong credit score, apply for new credit only when necessary and avoid making multiple applications in a short timeframe. Additionally, be mindful of the hard inquiries resulting from credit applications, as these can temporarily lower your score.

Crediful is your go-to destination for all things related to personal finance. We're dedicated to helping you achieve financial freedom and make informed financial decisions. Our team of financial experts and enthusiasts brings you articles and resources on topics like budgeting, credit, saving, investing, and more.