Maintaining a healthy credit report is essential for achieving financial goals, such as securing loans or getting favorable interest rates. Public records can negatively impact your credit report and, ultimately, your financial well-being.

In this article, we’ll discuss what public records are, how they affect your credit score, and the steps you can take to remove them from your credit report.

What is a public record on your credit report?

Public records are information pertaining to legal matters that have a direct impact on your finances. They list things like paid and unpaid debts, legal liabilities, and your payment history.

They tell a creditor if you are a good risk for a loan. When you are taken to small claims court, and a judge makes a ruling against you, this judgment is considered a public record.

Public records include foreclosures, bankruptcies, tax liens, civil judgments, and lawsuits, all of which are all required by law to be kept on file.

The Impact of Different Public Records on Your Credit Score

The effects of public records on your credit score vary depending on the type of record:

- Bankruptcies: A bankruptcy can remain on your credit report for up to ten years, severely damaging your credit score. Chapter 7 bankruptcies, which involve liquidation of assets, typically have a more significant impact than Chapter 13 bankruptcies, which involve a repayment plan.

- Foreclosures: A foreclosure can remain on your credit report for up to seven years and significantly lower your credit score.

- Tax liens and civil judgments: Legally, paid tax liens and civil judgments can be included on your credit reports for up to seven years. Unpaid tax liens can stay on your credit report indefinitely. However, the three major credit bureaus have revised their policies and now exclude these public records from consumer credit reports.

Strategies for Removing Public Records From Your Credit Report

Here are some key strategies for removing public records from your credit report:

Verify the Accuracy of Public Records

Before attempting to remove a public record from your personal credit report, ensure that the information is accurate and up-to-date. If you identify any errors, gather supporting documentation and prepare a clear explanation of the inaccuracies.

File Disputes with Each Credit Bureau

Under the Fair Credit Reporting Act (FCRA), you are entitled to dispute inaccurate information on your credit reports, including public records. To do so, you’ll need to follow these steps:

- Gather documentation: Collect any supporting documents that can help prove the public record on your credit report is inaccurate. This may include court documents, payment receipts, or correspondence with the relevant government agency or creditor.

- Write a dispute letter: Draft a clear and concise dispute letter for each credit bureau, explaining the inaccuracies and providing the necessary details about the public record in question. Be sure to include your name, address, date of birth, and Social Security number for identification purposes.

- Submit your disputes: File separate disputes with each of the three major credit bureaus – Equifax, Experian, and TransUnion. You can submit your disputes online, by mail, or over the phone. When submitting your disputes, attach copies of your supporting documents and include your dispute letter. Keep a copy of all your correspondence for your records.

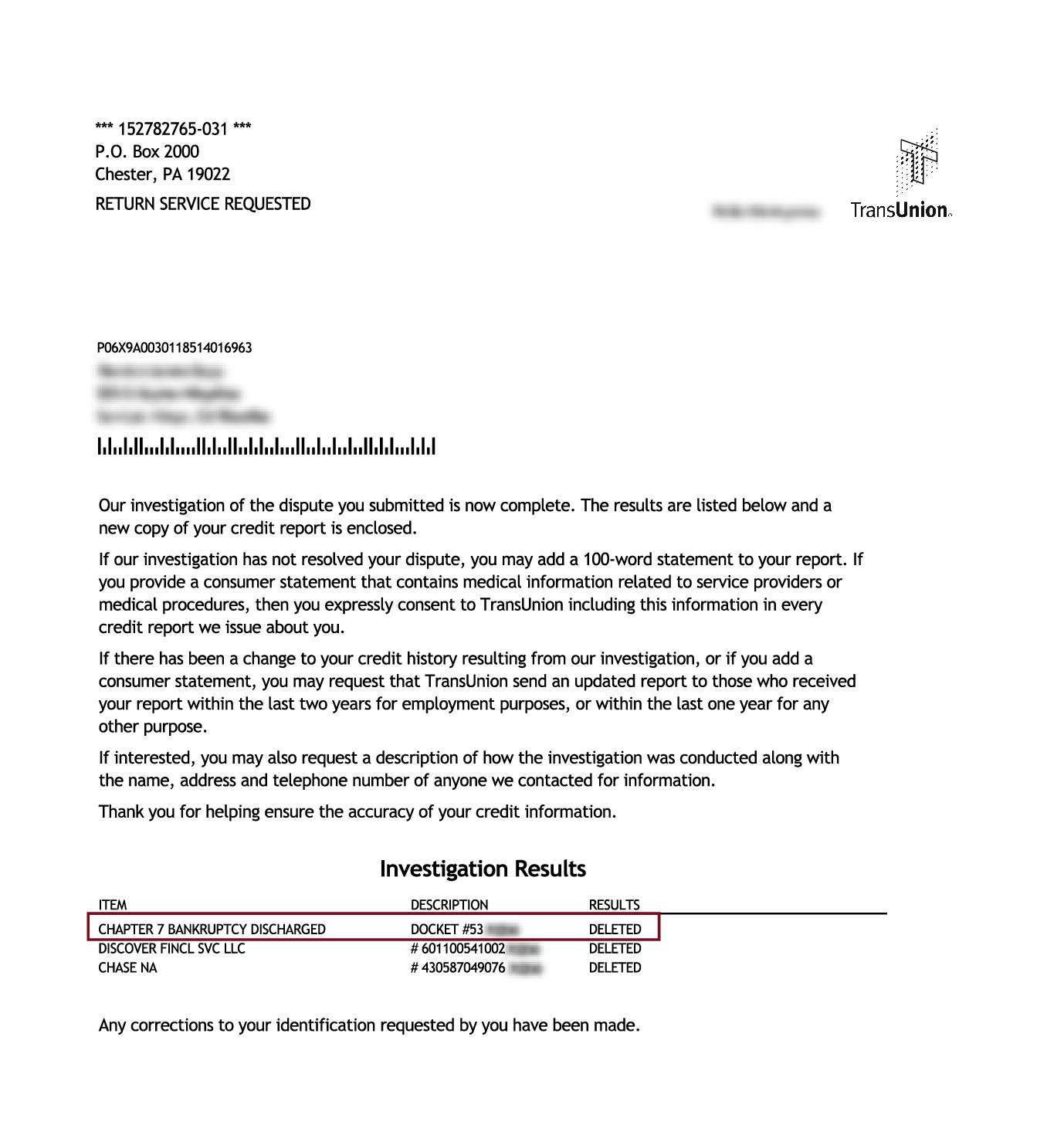

- Monitor the dispute process: The credit bureaus have up to 30 days to investigate your dispute and respond. They may contact the relevant parties involved in the public record to verify the information. If the credit bureau determines the information is indeed inaccurate, they will update your credit report accordingly.

- Review the results: After the dispute process is complete, the credit bureau will notify you of the outcome. If your dispute was successful, make sure to review your updated credit report to confirm that the public record has been corrected or removed. If the dispute was unsuccessful and you still believe the information is inaccurate, you may need to provide additional documentation or consider other options, such as contacting the source of the information directly or seeking legal advice.

Contact the Court or Government Agency Involved

In some cases, you may need to contact the court or government agency responsible for the public record to request its removal. This process can be more complicated than disputing the information with the three credit bureaus.

You may have to provide additional documentation or attend a hearing to support your case. Be persistent and organized, as this step can make a significant difference in the outcome of your dispute.

Consider Hiring a Professional Credit Repair Company

If the process of removing a public record from your credit report becomes overwhelming or time-consuming, consider hiring a professional credit repair company like Credit Saint. These companies have experience handling the complexities of credit repair and can help streamline the process for you.

They can help you dispute (and possibly remove) the following items:

- late payments

- collections

- charge offs

- foreclosures

- repossessions

- bankruptcies

Visit their website and fill out the form for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

Bankruptcy (Public Record) Removed From Credit Report

Ready to Raise Your Credit Score?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.

Frequently Asked Questions

Do public records affect your credit score?

Having a public record on your credit report negatively impacts your credit score. Public records can be a deciding factor when a lender is making a financial decision.

Removing a bankruptcy from your credit report can be a time-consuming job. If you have public records dragging your credit score down, get professional help to have them removed. If you’re able to remove any kind of negative information from your credit history, it should definitely improve your credit score.

What kind of information is included in a public record?

If you file for bankruptcy, the amount the court found you were legally responsible to pay will be listed. There will also be an exempt amount. This is the amount the court says you are not responsible to pay.

Lastly, there will be an asset amount for the number of personal assets the court used to make its decision. These will all be listed in the bankruptcy and are the kind of public records that can significantly lower your credit scores and affect your borrowing power.

What information is not part of your public record?

You may feel like your whole life is on display, but it’s not entirely. There are a few categories of strictly confidential records that are protected by law. Confidential records include welfare benefits, income tax, education level, and medical and criminal records.

These records are kept confidential because they contain Social Security numbers, contact information, health history, and financial information.

How are public records made public?

The government takes making public records available to the public very seriously. It runs a service called PACER that is provided by the federal judiciary. PACER is short for Public Access to Court Electronic Records.

This is an electronic public access service. It lets users get case and docket information from federal appellate, district, and bankruptcy courts via the Internet.

The federal website for PACER says that it currently hosts over 500 million case file documents. These are available immediately after they have been electronically filed.

This is one of the ways your records become public records. This also allows your information to be reported to the three credit reporting agencies.