Having a lower credit score can make borrowing more expensive and limit your options. But your score doesn’t have to stay where it is.

With consistent steps, you can improve your credit and qualify for loans, credit cards, and better rates. Below, we explain what a 644 credit score means—and how to start building stronger credit.

Is 644 a good credit score?

Credit scores typically range from 300 to 850, with higher scores making it easier to qualify for loans and credit. As you can see below, a 644 credit score is considered Fair. For context, the average credit score in America is 718.

| Credit Score | Credit Rating | % of population[1] |

| 300 – 579 | Poor | 16% |

| 580 – 669 | Fair | 17% |

| 670 – 739 | Good | 21% |

| 740 – 799 | Very Good | 25% |

| 800 – 850 | Exceptional | 21% |

644 Credit Score Credit Card & Loan Options

Many lenders are cautious about lending to borrowers with Fair credit scores. As a result, your financing options will be somewhat limited. With a score of 644, your focus should be on building your credit history and raising your credit scores before applying for any loans.

A quick way to build credit is by becoming an authorized user on someone’s credit account if they have good credit. You could also ask someone with strong credit to cosign for you, but it can hurt their credit score if you miss payments or default on the loan.

644 Credit Score: Qualifying for Credit Cards

Credit card applicants with a credit score in this range may be required to put down a security deposit. Applying for a secured credit card is probably your best option. However, credit card issuers often require a security deposit of $500 – $1,000. You may also be able to get a “starter” credit card from a credit union. It’s an unsecured credit card, but it comes with a low credit limit and high interest rate.

If you are able to get approved for a credit card, you must make your monthly payments on time and keep your balance below 30% of your credit limit.

See also: 8 Best Secured Credit Cards

644 Credit Score: Personal Loan Approval

Very few lenders will approve a personal loan for someone with a 644 credit score. Some lenders do work with lower credit scores, but their personal loans usually have high interest rates.

Avoid payday loans and other high-interest options, as they can trap you in debt and damage your credit further.

To build credit, applying for a credit builder loan may be a suitable option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

See also: 7 Best Personal Loans for Bad Credit

Qualifying for a Mortgage With a 644 Credit Score

The minimum credit score required by most conventional mortgage lenders is around 620.

However, for those interested in applying for an FHA loan, applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10%. Those with a credit score of 580 can qualify for a down payment as low as 3.5%.

See also: 8 Best Mortgage Loans for Bad Credit

Getting an Auto Loan With a 644 Credit Score

Some auto lenders will not lend to someone with a 644 score. If you manage to get approved for a car loan with a 644 score, it could be expensive. Improving your credit score makes qualifying for a car loan much easier.

See also: 7 Best Auto Loans for Bad Credit

How to Improve a 644 Credit Score

A Fair credit score often indicates a history of credit mistakes or errors. For example, you may have some late or missed payments, charges offs, foreclosures, and even bankruptcies showing up on your credit report.

Here are five ways to improve your 644 credit score:

1. Dispute Negative Accounts on Your Credit Report

Check your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion, to see what’s being reported and spot any potential errors. If you find any negative items, you may want to hire a credit repair company such as Credit Saint. They can help you dispute them and possibly have them removed.

They focus on removing inaccurate negative items from your credit report and have helped clients for over 15 years.

They can help you with the following items:

- hard inquiries

- late payments

- collections

- charge offs

- foreclosures

- repossessions

- judgments

- liens

- bankruptcies

2. Take Out a Credit Builder Loan

Credit builder loans are installment loans designed to help people build or rebuild their credit history. They don’t require a credit check and are one of the easiest, most affordable ways to build your credit scores.

With credit builder loans, the money sits in a savings account until you’ve completed all your monthly payments. The loan payments are reported to at least one credit bureau, which gives your credit scores a boost.

See also: 7 Best Credit Builder Loans

3. Get a Secured Credit Card

Getting a secured credit card is a great way to establish credit. Secured credit cards work like regular credit cards, but they require a security deposit that also acts as your credit limit. If you miss payments or fail to pay your balance, the credit card issuer keeps your deposit.

4. Become an Authorized User

If you are close to someone who has excellent credit, becoming an authorized user on their credit account, is the fastest way to raise your credit scores. Their account information gets added to your credit report, which can help raise your credit scores right away.

5. Build Credit by Paying Your Rent

Most rent and utility payments aren’t reported to the three credit bureaus by default. However, for a small fee, rent reporting services will add your payments to your credit report, which will help you improve your credit scores.

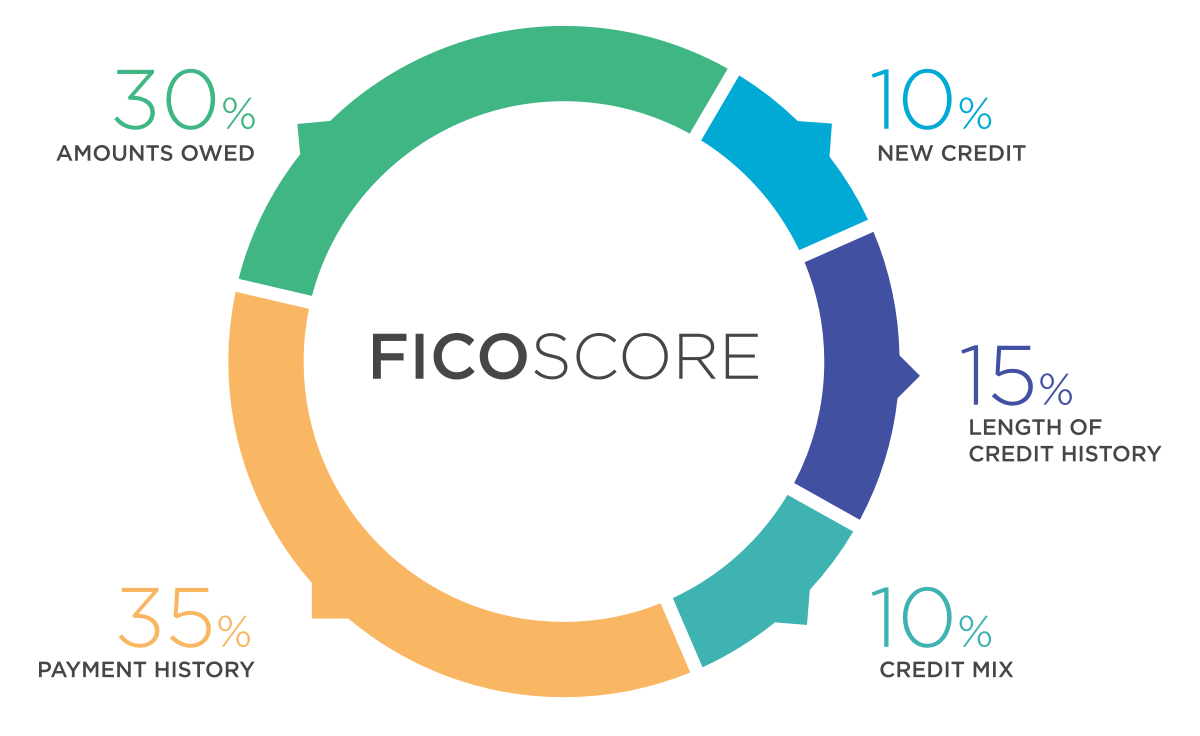

Key Factors That Shape Your FICO® Score

Your FICO® score is determined by several factors, and each one affects your score differently. Knowing how these factors work can help you focus on ways to improve your credit. Here’s how your FICO® score is calculated:

1. Payment History (35%)

Payment history is the biggest factor that impacts your FICO® score. Lenders want to see that you can consistently pay your bills on time. Late payments, delinquencies, and defaults negatively impact this portion of your credit score. Even one late payment can lower your score, so it’s important to make timely payments.

2. Credit Utilization Rate (30%)

This shows how much of your available credit you’re using at any given time. Credit utilization refers to the ratio of your current balances to your credit limits. Experts recommend keeping this ratio under 30% to avoid lowering your credit score. For example, if you have a credit limit of $10,000 across all cards, your total balance should ideally be less than $3,000.

3. Length of Credit History (15%)

The age of your credit accounts matters. The longer your credit history, the more favorable it is for your credit score. This includes both the age of your oldest account and the average age of all your accounts. If you’re new to credit, be patient and maintain good habits—your score will improve over time as your accounts age.

4. Credit Mix (10%)

Your FICO® score also benefits from having a diverse mix of credit accounts. This could include both revolving credit (such as credit cards) and installment loans (like auto loans or mortgages). Lenders see borrowers who manage different types of credit as less of a risk.

5. New Credit Inquiries (10%)

Every time you apply for credit, a hard inquiry is recorded on your report, and too many of these inquiries can lower your credit score. While one or two inquiries may only cause a small dip, regularly applying for new credit can signal financial instability to lenders. It’s important to limit new credit applications unless absolutely necessary.

Putting Your Knowledge into Action

Now that you understand the key factors influencing your FICO® score, you can focus on specific actions to improve it. Here are some targeted steps to help you move forward:

- Pay down your balances: Keeping your credit card balances low is one of the best ways to improve your credit scores. If your cards are close to their limits, paying them down should be a top priority.

- Diversify your credit accounts: A mix of revolving credit (credit cards) and installment loans (like auto loans) can help your credit scores. Lenders like to see that you can manage different types of credit responsibly.

- Make timely payments: Late payments can severely damage your credit scores. Set up reminders or automatic payments so you never miss a due date. Even one missed payment can set back your progress significantly.

- Build your credit history: A longer credit history helps demonstrate reliability to lenders. If you’re just starting, patience is key. Consider keeping your existing credit card accounts active, even if you’re not using them frequently, as closing them can shorten your credit history and negatively affect your credit scores. Maintain low balances and avoid applying for new credit unless absolutely necessary.

Building good credit takes time, but the right actions can help you get there faster. Start by checking your credit report for errors and putting a plan in place to strengthen your credit score.

If you want expert help, Credit Saint offers free consultations to assess your situation—and they even back their services with a 90-day money-back guarantee. Visit Credit Saint or call (855) 281-1510 to get started today.