A good credit score can make it easier to qualify for loans, credit cards, and better rates. But even with a score in this range, improving your credit can open more doors.

Below, we explain what a 684 credit score means—and how to keep building toward excellent credit.

Is 684 a good credit score?

Credit scores typically range from 300 to 850, with higher scores making it easier to qualify for loans and credit. As you can see below, a 684 credit score is considered Good. For context, the average credit score in America is 718.

| Credit Score | Credit Rating | % of population[1] |

| 300 – 579 | Poor | 16% |

| 580 – 669 | Fair | 17% |

| 670 – 739 | Good | 21% |

| 740 – 799 | Very Good | 25% |

| 800 – 850 | Exceptional | 21% |

684 Credit Score Credit Card & Loan Options

Most lenders will lend to borrowers with credit scores in the Good range. However, there’s still room to improve your credit. With a score of 684, it’s smart to work on raising your credit scores before applying for loans to qualify for better rates.

684 Credit Score: Qualifying for Credit Cards

With a credit score in this range, you may be eligible for most credit cards. However, some credit cards require a higher credit score.

If you get approved for an unsecured credit card, always make your payments on time and keep your balance low. Using your card responsibly can help protect your credit score and improve it further.

684 Credit Score: Personal Loan Approval

Most personal loan lenders will approve you for a loan with a 684 credit score. However, interest rates may be higher compared to someone with “Very Good” or “Excellent” credit.

Avoid payday loans and other high-interest options, as they can trap you in debt and damage your credit further.

See also: 10 Best Personal Loans for Good Credit

Qualifying for a Mortgage With a 684 Credit Score

The minimum credit score is around 620 for most conventional lenders, so you should be able to qualify. However, you may need a higher credit score to access the most competitive rates and terms on a conventional loan.

If your credit score is holding you back from better offers, focus on building it up before applying. Lender requirements can also vary, so take the time to compare options and shop around.

See also: 10 Best Mortgage Lenders for Good Credit

Getting an Auto Loan With a 684 Credit Score

Most auto lenders will lend to someone with a 684 score. But, improving your credit can help you qualify for better interest rates.

Lenders also consider other factors when deciding whether to approve your loan and what interest rate to offer. These include your income, job history, debt-to-income ratio, and loan amount.

Review your financial situation before applying for a loan to help present yourself as a reliable borrower and improve your chances of approval. You can also compare offers from multiple lenders to find the best deal for your needs.

See also: 10 Best Auto Loans for Good Credit

How to Improve a 684 Credit Score

Credit scores in the Good range often reflect a history of paying your bills on time. However, you still may have some late payments or charges offs reporting.

Here are five ways to improve your 684 credit score:

1. Dispute Negative Accounts on Your Credit Report

Check your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion, to see what’s being reported and spot any potential errors. If you find any negative items, you may want to hire a credit repair company such as Credit Saint. They can help you dispute them and possibly have them removed.

They focus on removing inaccurate negative items from your credit report and have helped clients for over 15 years.

They can help you with the following items:

- hard inquiries

- late payments

- collections

- charge offs

- foreclosures

- repossessions

- judgments

- liens

- bankruptcies

2. Take Out a Credit Builder Loan

Credit builder loans are installment loans designed to help people build or rebuild their credit history. They don’t require a credit check and are one of the easiest, most affordable ways to build your credit scores.

With credit builder loans, the money sits in a savings account until you’ve completed all your monthly payments. The loan payments are reported to at least one credit bureau, which gives your credit scores a boost.

See also: 7 Best Credit Builder Loans

3. Get a Secured Credit Card

Getting a secured credit card is a great way to establish credit. Secured credit cards work like regular credit cards, but they require a security deposit that also acts as your credit limit. If you miss payments or fail to pay your balance, the credit card issuer keeps your deposit.

See also: 8 Best Secured Credit Cards

4. Become an Authorized User

If you are close to someone who has excellent credit, becoming an authorized user on their credit account, is the fastest way to raise your credit scores. Their account information gets added to your credit report, which can help raise your credit scores right away.

5. Build Credit by Paying Your Rent

Most rent and utility payments aren’t reported to the three credit bureaus by default. However, for a small fee, rent reporting services will add your payments to your credit report, which will help you improve your credit scores.

Where to Go from Here

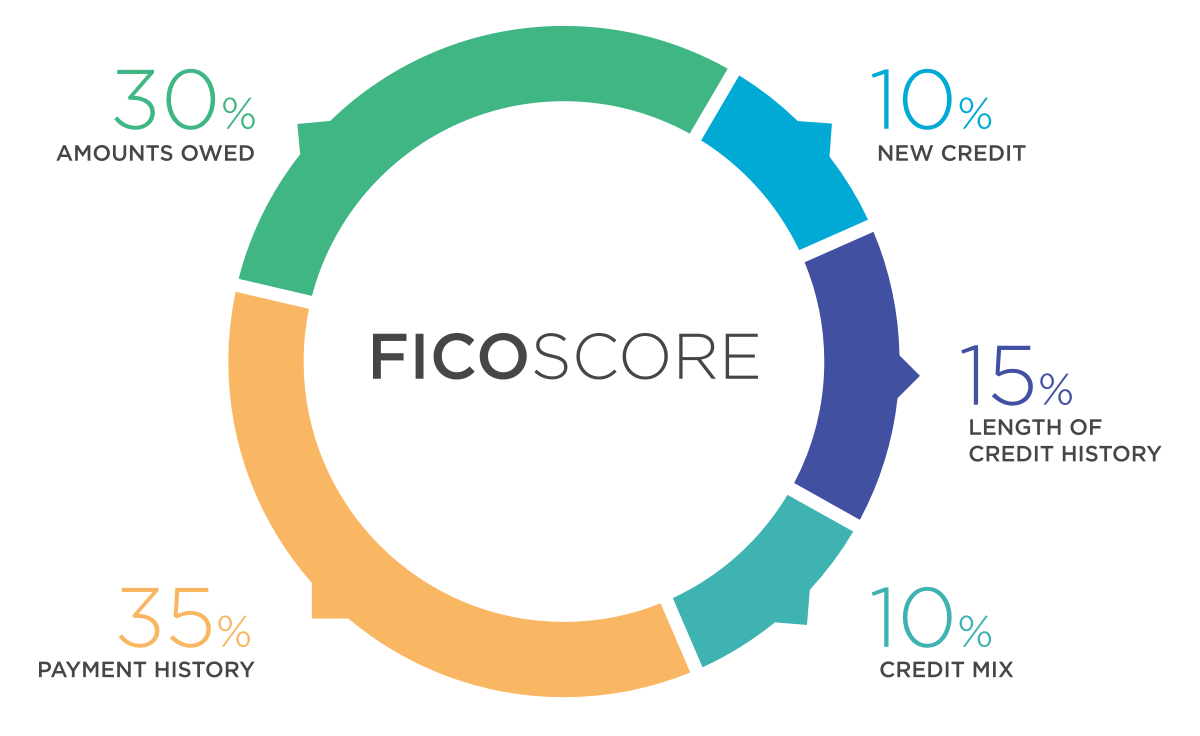

It’s important to know which factors make up your credit score. As outlined in the image below, there are 5 factors that make up your credit score.

Pay down your balances and keep your credit utilization under 30%. It’s also wise to have different types of credit accounts to establish a solid credit mix because it accounts for up to 10% of your FICO score. So, you’ll want to have both installment and revolving credit showing up on your credit reports.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

The length of your credit history is another important factor in your credit scores. A long, positive payment history shows creditors you can manage credit responsibly.

Building excellent credit takes time, but you can speed up the process by taking the right steps. Visit Credit Saint or call (855) 281-1510 for a free credit consultation and start repairing your credit today. They even offer a 90-day money-back guarantee, so there’s no risk in getting started.