With a higher credit score, you’re more likely to qualify for loans, credit cards, and competitive interest rates. But even strong credit can improve with the right habits.

Below, we explain what a 765 credit score means—and how to keep building your credit.

Is 765 a good credit score?

Credit scores typically range from 300 to 850, with higher scores making it easier to qualify for loans and credit. As you can see below, a 765 credit score is considered Very Good. For context, the average credit score in America is 718.

| Credit Score | Credit Rating | % of population[1] |

| 300 – 579 | Poor | 16% |

| 580 – 669 | Fair | 17% |

| 670 – 739 | Good | 21% |

| 740 – 799 | Very Good | 25% |

| 800 – 850 | Exceptional | 21% |

765 Credit Score Credit Card & Loan Options

Borrowers with credit scores in the Very Good range should have no issues qualifying for a loan or credit card. With a credit score of 765, your focus should be maintaining your credit status to make sure you continue to get the most favorable loan terms available.

765 Credit Score: Qualifying for Credit Cards

With a credit score in this range, you may be eligible for most credit cards. Remember to always make your monthly payments on time and keep your balance below 30% of your credit limit.

765 Credit Score: Personal Loan Approval

Most personal loan lenders will approve you for a loan with a 765 credit score. You’ll likely qualify for the best rates lenders offer. But, your credit score isn’t the only factor lenders look at when reviewing your application. They’ll also consider your income, debt, and employment history.

See also: 10 Best Personal Loans for Good Credit

Qualifying for a Mortgage With a 765 Credit Score

The minimum credit score is around 620 for most conventional lenders, so you should qualify with no issues. With a higher credit score, you can expect the best interest rates and loan terms. This can save you thousands of dollars over the life of the loan.

See also: 10 Best Mortgage Lenders for Good Credit

Getting an Auto Loan With a 765 Credit Score

Most auto lenders will lend to someone with a 765 score. With Very Good credit scores, you should qualify for the best interest rates they have to offer. However, lenders also look at other factors, so there’s no guarantee that you’ll be approved for a loan.

See also: 10 Best Auto Loans for Good Credit

How to Improve a 765 Credit Score

Having a credit score in the Very Good range generally indicates a history of prompt bill payments, but there might be some late payments or charge-offs still reported. To boost that 765 credit score, follow these expert tips:

Start by Reviewing Your Credit Reports

Begin by requesting a free copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Carefully review each credit report to identify any negative items that could be impacting your credit scores.

While reviewing your reports, pay particular attention to any inaccuracies, such as incorrect account details, duplicate accounts, or outdated negative items. If you discover any errors, you can dispute them directly with the credit bureaus. Correcting these inaccuracies can result in a quick boost to your credit score.

Get Help From a Credit Repair Company

If your credit reports contain negative items, think about enlisting the help of a credit repair company like Credit Saint. Their team of experts can assist you in disputing these items and potentially have them removed.

With over 15 years of experience, they have worked with clients to address incorrect entries on credit reports. Their expertise covers a wide range of issues, including:

- Hard inquiries

- Late payments

- Collections

- Charge-offs

- Foreclosures

- Repossessions

- Judgments

- Liens

- Bankruptcies

To receive a free credit consultation, visit Credit Saint or call (855) 281-1510 and get started on your credit repair journey. They even offer a 90-day money-back guarantee—so there’s no reason to wait.

Focus on These 5 Factors to Build Excellent Credit

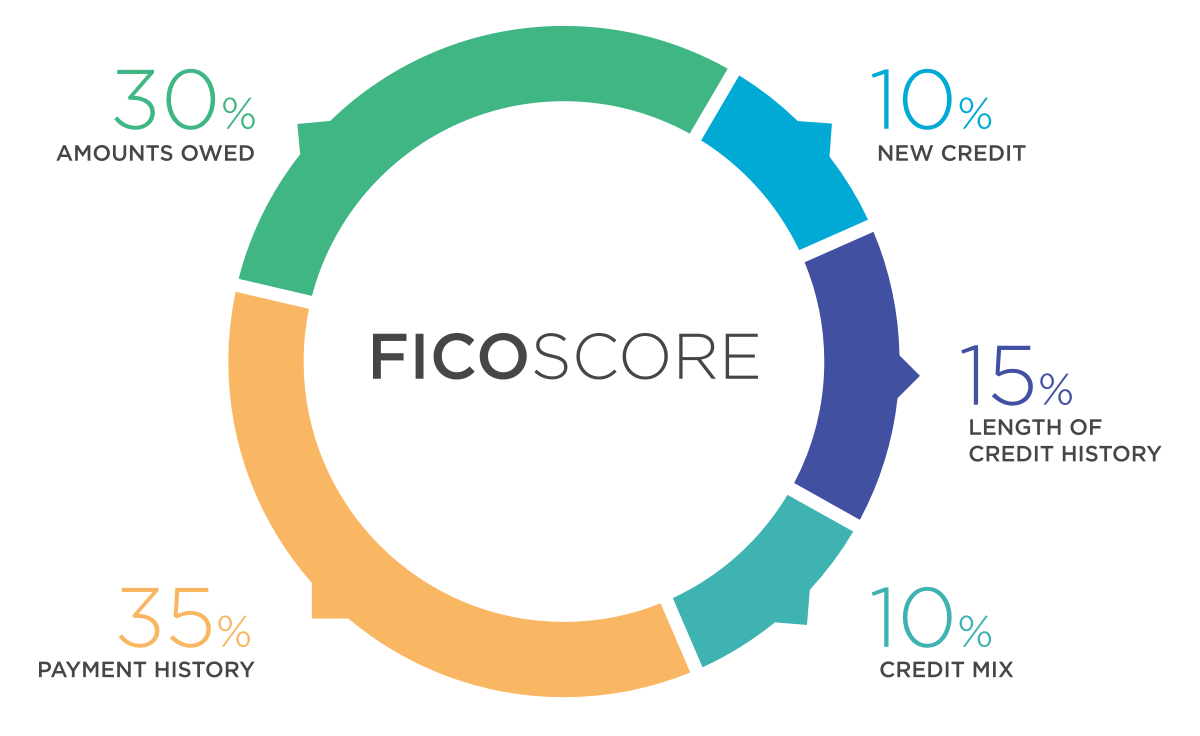

Your FICO credit score is built on five key factors. Here’s how each one works—and how to stay on top of them.

Payment History (35% of your FICO score)

On-time payments are the most important part of your credit score. Late or missed payments can do serious damage, so set reminders, automate payments, or create a budget to stay consistent.

Credit Utilization (30% of your FICO score)

Credit utilization is the percentage of available credit you’re using. Try to keep it below 30%. For example, if your credit limit is ,000, avoid carrying a balance over ,000. Pay down balances often, limit credit card spending, and monitor your usage.

Length of Credit History (15% of your FICO score)

A longer credit history is better for your credit score. Lenders see a long track record of on-time payments as a sign of reliability. Don’t close your oldest accounts—even if you rarely use them. Keep them open and make small purchases to keep them active.

Credit Mix (10% of your FICO score)

A healthy credit mix shows you can handle different types of accounts. Aim for a balance between revolving credit (like credit cards) and installment loans (like car loans, mortgages, or student loans). You don’t need to open new accounts just to diversify—just show responsible use across what you already have.

New Credit (10% of your FICO score)

Applying for several new credit accounts in a short time can lower your credit score and make lenders view you as a risk. Only apply when you need to, and avoid submitting multiple applications close together. Each one creates a hard inquiry, which can cause a temporary dip in your score.