Your credit score is calculated using a complex algorithm based on several factors. So to improve your credit score, it’s essential to understand how credit bureaus determine it so that you can take strategic actions to improve it.

FICO Credit Scoring Model

FICO scores, the most commonly used credit scoring model in the nation, use five different categories to determine your creditworthiness:

- Payment history

- Amounts owed

- Length of credit history

- New credit

- Types of credit accounts

Most of those categories are pretty self-explanatory. However, many consumers are unfamiliar with the different types of credit and how they affect credit scores.

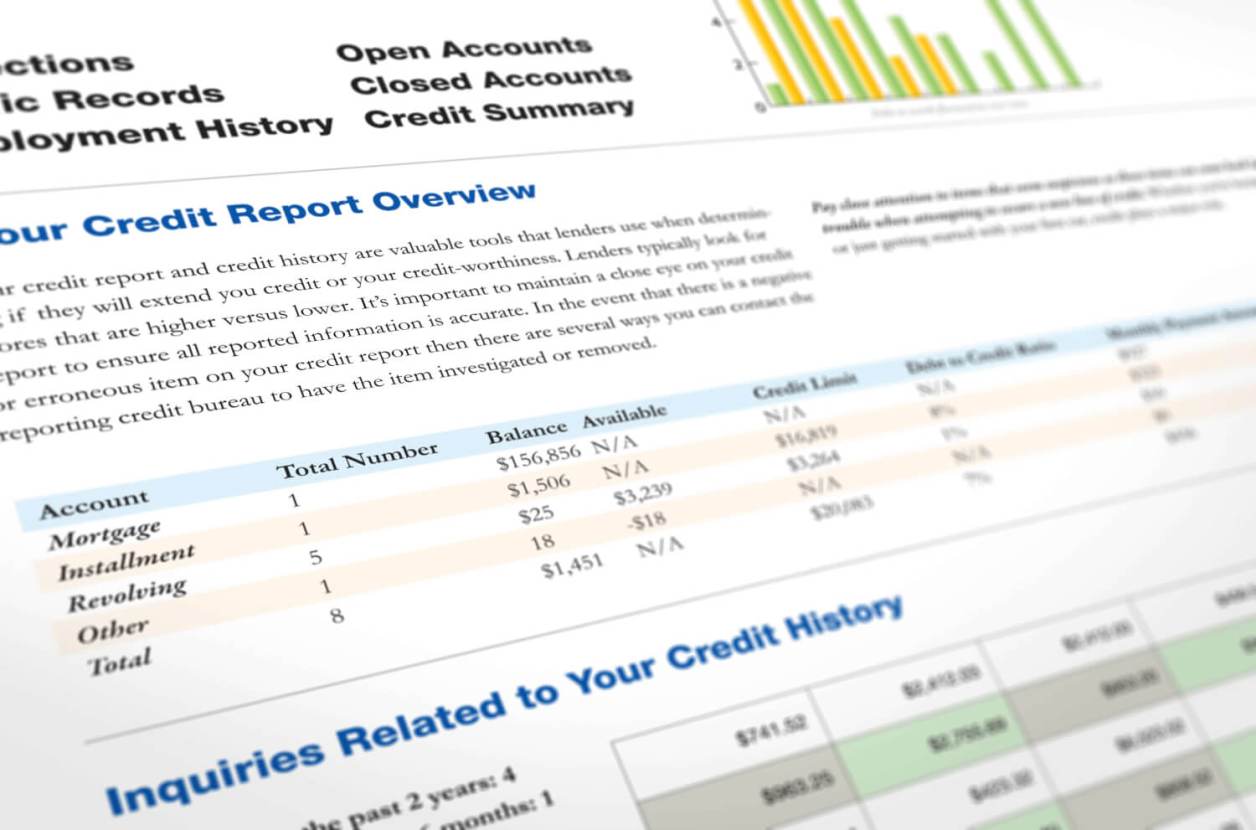

The ‘types of credit’ category constitutes 10% of your credit score. The three types of credit accounts include revolving, installment, and open accounts.

We’ll show you why having a balanced mix of accounts is important and what each different type of credit account entails. Then we’ll give you action-oriented steps to maximize your credit score in this category. Let’s get started.

Why is having different types of credit important?

Despite only contributing 10% to your FICO score, different types of credit are an essential component in determining that final number, particularly if your credit history is limited.

The purpose of both your FICO credit score and your credit report is to help lenders ascertain how much of a risk you pose if they lend you money. For example, will you make consistent payments on time each month, or are you likely to default on the loan?

If you have a lengthy credit history with multiple items on your credit report, a lender can get a pretty good idea of your potential credit risk. But if you have little or no credit, it becomes more difficult. In these situations, lenders look more closely at your credit mix.

This may raise eyebrows because lenders will see that you may not have a history of regular payments on other types of loans. While every individual’s situation is different, it’s typically better to have various accounts to increase your credit scores.

Three Types of Credit Accounts

Now that you understand why credit mix is important, it’s time to learn which ones are available to you as a consumer.

As mentioned, credit comes in three different forms: installment, revolving, and open. While each type of credit account can affect your credit scores differently, most financial experts agree that it is best to have a healthy mix.

What is an installment account?

Installment credit refers to a type of loan that allows you to borrow a fixed sum upfront, which you repay regularly over time. Your payment is the same each month and is spread out over a specified length of time. The lender charges you interest on the borrowed amount, which is included in your monthly payment. Interest rates can either be fixed or variable.

If it is fixed, you’ll pay the same interest rate for the life of the loan. If it’s variable, your interest rate, and consequently, your monthly payment, may fluctuate up or down based on market conditions.

Installment Loans

Installment loans can be used to finance major purchases that may be difficult to afford upfront with cash. For example, a mortgage is a common type of installment loan.

For a mortgage, each month a portion of the payment is applied towards the principal balance and a portion is applied towards interest. It’s typically over a 30-year period (although shorter loan terms, such as 15 years, are also available).

Car loans, student loans, home equity loans, and personal loans are also examples of installment loans.

What is a revolving account?

Revolving credit accounts do not have a pre-determined payment schedule. The most common example of a revolving credit account is a credit card.

With a credit card, you have a set credit limit of how much money you may borrow. Then, you determine how much of the balance you wish to pay each month—the minimum or more. The name comes from the ability to revolve your balance to next month’s bill.

You can use your credit card repeatedly but are charged interest on the amount you borrow. As a result, your available credit decreases the more you spend and subsequently increases as you pay off your balance.

Credit Cards

Estimates show that over 72% of Americans carry at least one credit card, whether it’s Visa, MasterCard, American Express, Discover, or less common brands.

Other types of credit cards include those from retailers, which you can only use at that specific store. With these credit cards, cardholders usually receive benefits, like additional discounts or coupons. Gas cards are also considered revolving credit.

Credit cards typically allow you to pay off the total amount owed in full or make a minimum payment and carry a balance. But, of course, you can always pay more than the minimum payment to not be charged as much in interest.

If you’re struggling to get a credit card because of poor credit, you may want to consider getting a secured credit card to get started. Secured credit cards are generally offered to anyone willing to put down a security deposit as collateral. However, they can be an effective way to build credit as the payment history is reported to the credit bureaus.

Home Equity Lines of Credit

Revolving accounts don’t just include credit cards. For example, a home equity line of credit (also called a HELOC) lets homeowners access their home equity without taking out a lump sum all at once.

Instead, you receive a line of credit from your bank or credit union. Like a credit card, you take out the money as you need it, and only then does that amount begin to accrue interest.

Since you’re using money from the equity in your home, you can usually claim the interest as a tax deduction. Then, as you borrow money from the HELOC, you begin to repay it as you would a credit card balance, and your available credit goes back up.

What is an open credit account?

Open credit accounts essentially combine the two concepts of installment and revolving credit. Your monthly payment varies each month. You must pay your balance in full rather than carrying a balance over to the next month. Examples of open accounts are utility bills such as electricity, gas, water/sewage, garbage, internet, and cable TV.

Your bill varies depending on your usage each month, and you’re expected to pay the entire amount by the due date. Cell phones and company charge cards are other forms of open credit. Charge cards are similar to credit cards but have no preset credit limit.

Paying your open accounts on time each month, unfortunately, doesn’t help your credit. However, not paying them does hurt your credit scores. A utility or cell phone company doesn’t regularly report on-time monthly payments. However, they will almost certainly report delinquencies. Past due accounts are usually reported when they are late by 30 days or more.

How Different Types of Credit Affect Your Credit Score

There’s no one-size-fits-all solution to improving your credit score, but it can be helpful to have a diverse mix of credit types. This shows lenders that you don’t rely on just one type of credit, especially credit cards. Lenders might also make a few other assumptions based on the credit mix of your credit reports.

Installment loans, for example, can help your credit because they build up a positive payment history. This shows lenders that you are a reliable borrower.

Additionally, some types of installment credit are considered a “good” type of credit. A mortgage, for example, typically indicates you are building equity that you could potentially later tap into.

Student loans might make a lender think that your long-term earning potential is higher because you have a college degree. However, a car loan is sometimes viewed as a “bad” type of credit because the vehicle’s value depreciates quickly compared to the loan amount.

How much credit is too much?

Lenders don’t want to see too much revolving credit being used because it could indicate you are in financial distress and often need quick access to money. However, that doesn’t mean you should immediately close extraneous credit cards.

First, closing old accounts won’t automatically make them go away on your credit report. And second, closing old credit card accounts can actually hurt your credit score.

Getting Your Credit Mix Right

There is no specific formula to get the perfect balance of “credit mix.” However, having various types of credit will create a good credit mix. With that said, it’s typically not wise to take out a loan just for the sake of adding an installment loan.

On the other hand, credit builder loans were created specifically for people with a limited credit history to build credit. However, they are very cost-effective, and you’re basically borrowing from yourself, similar to a secured credit card.

If you are carrying credit card debt, you may want to consider transferring it to a personal loan with a lower interest rate. By getting creative, you can simultaneously repair your credit and save yourself some cash in interest payments.