Are you having trouble finding your bank routing number? Don’t worry, you’re not alone.

Many people have trouble locating this important piece of information. This article will walk you through some simple steps you can take to find your routing number quickly and easily.

What is a routing number?

A routing number, also known as an ABA routing number or routing transit number, is a unique nine-digit code assigned to financial institutions by the American Bankers Association (ABA).

This number is used to identify the specific bank or credit union during financial transactions such as direct deposit, online payments, and wire transfers. It’s also used to process and clear checks.

Where can I find my routing number?

Finding your bank routing number can be done through a few simple methods. Here are the most common ways to locate your routing number.

1. Look on Your Check

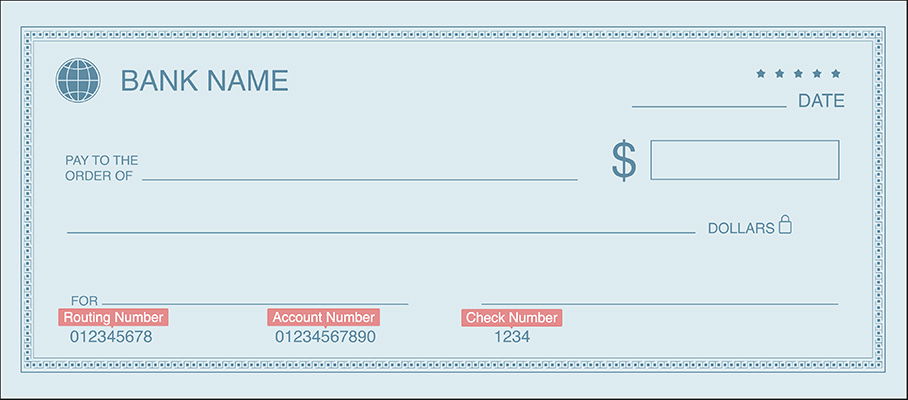

One of the ways to find your routing number is to look in the bottom-left corner of a personal check.

To ensure that you don’t provide the wrong number, it’s helpful to understand the three sets of numbers typically found on personal checks.

The first set of nine digits is your routing number. The second set represents your personal checking account number and indicates from which account the payment will be made. Lastly, the third set of numbers is the check number.

2. Login to Your Online Bank Account

Many banks and credit unions offer their customers the convenience of accessing their routing number through their online banking account. This can be a quick and easy way to locate your routing number without having to contact the bank or search for a check.

Some banks may have a specific section within the online banking portal where the routing number is prominently displayed, others may have in the settings or profile section.

Another place to check is your bank statement. Many banks include the routing number on your monthly bank statement. You can find your electronic bank statements via the bank’s website or mobile banking app.

3. Contact Your Bank

Another way to find your bank routing number is to contact your bank directly. Most banks have customer service teams that can provide your routing number either over the phone or via online chat.

To make sure the process goes smoothly when you reach out to your bank, have your checking account information at hand. The bank may need to ask for your account number or other identifying information to verify your identity, so having it ready will save time. Once you’ve provided the necessary information, the process of getting your routing number through this method is typically quick and easy.

4. ABA Online Lookup

The American Bankers Association (ABA) offers an online lookup tool on their website that can be used to find a bank’s routing number. The minimal information required to perform a search is the name of the financial institution and the state it is located in. To make the search more specific, you can also include the bank’s city and ZIP code.

What is a bank routing number used for?

A bank routing number serves several important functions in personal finance, including:

- Identifying a specific US bank

- Ensuring seamless electronic transactions, such as direct deposits and wire transfers, reach the correct bank

- Verifying the bank behind a paper check

- Streamlining automatic bill payments

- Facilitating online or mobile check deposits

- Streamlining wire transfers

- Setting up direct deposit for payroll or government benefits

- Supporting ACH (Automated Clearing House) payments

- Enabling seamless banking through online, telephone, and mobile channels.

Common Mistakes to Avoid When Using Routing Numbers

Using routing numbers can be tricky, but if you proceed with caution, you can avoid some common mistakes and ensure your transactions go smoothly. Here are a few things to watch out for:

- Confusing your routing number with your account number: These two numbers may look similar, but they serve different purposes. Your routing number identifies your bank and where your account is located, while your account number is used to identify your specific account. So, make sure you have the right number for the task at hand.

- Transposing numbers: It’s easy to accidentally switch around digits when you’re entering your routing number. To prevent this, double-check your numbers before hitting “submit” or “send.”

- Using an outdated routing number: Routing numbers can change for various reasons, such as bank mergers or rebranding. So, if you’re using a routing number from an old check or deposit slip, make sure it’s still valid by checking with your bank.

- Neglecting to include the check digit: Some routing numbers have a check digit at the end, which is used to verify the routing number’s accuracy. Make sure to include this digit when entering your routing number, or your transaction may be rejected.

How to Find a Routing Number on a Foreign Bank Account

Routing numbers are only used within the U.S. Most other countries utilize the International Bank Account Number (IBAN) system. This standardized code identifies a specific bank account and includes information about the country, bank, and account number. Depending on the country, an IBAN typically contains between 15 and 34 alphanumeric characters.

If you need to find the IBAN for an international bank, there are a few options available to you. One approach is to seek assistance from your domestic bank if they have a relationship with the foreign bank. Alternatively, you may need to contact the international bank directly or search for its IBAN online.