Are you tired of those pesky overdraft fees sneaking up on you when you least expect it? We know how frustrating it can be to see your hard-earned money vanish due to a simple oversight or financial hiccup. That’s why we’ve taken the time to thoroughly research and compile a list of the best checking accounts with no overdraft fees.

Say goodbye to those unwelcome charges and hello to financial peace of mind.

Top 10 Checking Accounts with No Overdraft Fees

Here are the top 10 checking accounts that won’t charge you for going a little over.

1. Current

- No credit check

- No minimum opening deposit or maintenance fees

- Get paid up to 2 days faster

- Overdraft up to $200 without any overdraft fees

2. SoFi

- Up to $300 sign-up bonus with direct deposit

- No minimum opening deposit

- Earn up to 3.80% APY

- Over 55,000 fee-free ATMs

3. GO2bank

- No credit check

- No minimum opening deposit

- No fees at over 19,000 ATMs

- Overdraft up to $200

4. Chase

- $100 bonus after 10 purchases in 60 days

- Over 16,000+ fee-free ATMs

- $4.95 monthly service fee

- No credit check or ChexSystems

5. American Express

American Express Rewards Checking is an excellent choice for those looking for a high-yielding checking account.

What is an Overdraft and Why It Matters

An overdraft occurs when you spend more money than you have available in your checking account, leading to a negative balance. This can happen for several reasons:

- Debit card purchases: A common reason many face overdrafts. You might think you have enough, but a pending transaction or a miscalculation can send your account into the red.

- ATM withdrawals: Taking out more cash than available can instantly lead to an overdraft. Some ATMs may warn you, while others might let the withdrawal go through, leading to a fee.

- Scheduled payments: Automatic payments for bills can result in an overdraft if you forget about them and don’t have sufficient funds.

Financial institutions use overdraft fees as a way to penalize (and profit from) these mistakes. Even though they may seem inconsequential initially, these fees can accumulate rapidly, especially if you’re unaware that you’ve overdrafted.

The True Cost of Overdraft Fees

The fee for an overdraft varies by bank, but is often around $35. While this may seem like a mere inconvenience, the costs can spiral in certain circumstances:

- Frequency: If you frequently find yourself overdrawing, these fees can quickly add up. Just three instances in a year, at $35 each, means you’ve paid $105 in fees alone.

- Extended overdraft fees: Some financial institutions charge an additional fee if your account remains negative for several days. This means, if you can’t get your account back in the positive quickly, you might face more charges.

- Multiple fees in a day: It’s not uncommon for banks to charge multiple overdraft fees in a single day. If several transactions send you into the negative, you could be hit with a fee for each one.

- NSF fees: On top of overdraft fees, if a check bounces or a scheduled payment fails due to insufficient funds, another fee can be levied.

Benefits of No Overdraft Fee Accounts

Choosing a bank account that doesn’t charge overdraft fees or has ways to mitigate them offers several advantages:

- Financial savings: Directly, you save money by not having to pay penalties. Indirectly, avoiding these overdraft fees and overdraft protection fees can help you maintain a healthier bank account balance, allowing you to manage your finances better and possibly even earn interest.

- Stress-free banking: One of the biggest reliefs of no overdraft fee accounts is the peace of mind. You won’t need to constantly worry about every transaction and whether you’ve miscalculated by a few cents.

- Positive financial behavior: Such accounts often encourage users to be more mindful of their spending and to maintain a buffer in their account. Over time, this can instill better money management habits.

- Avoidance of snowball effect: Overdraft fees can create a domino effect. If you’re unaware of the first fee, you might continue spending, leading to more fees. No overdraft fee accounts halt this cycle before it begins.

Other Features to Consider in a Checking Account

Choosing the right checking account means considering more than just overdraft fees. Here are other essential factors:

Interest Rates/APY

- What it is: APY represents how much your money grows over a year.

- Why it matters: Some accounts, especially online banks or money market accounts, offer competitive rates. Even a small difference can lead to more earnings, especially if you keep a larger balance.

Minimum Balance Requirements

- Avoiding fees: Some banks waive monthly fees if you maintain a specific minimum balance. Understand these requirements to avoid surprises.

- Tiered benefits: Higher balances might unlock additional benefits, but ensure it doesn’t restrict your daily financial needs.

ATM Fees

- Own bank vs. third-party: Using your bank’s ATM is usually free. However, third-party ATMs can incur charges from both the ATM provider and your bank.

- Reimbursements: Some banks reimburse ATM fees, valuable if you often use different ATMs or travel.

Online Banking

- Cost savings: Online banks, without physical branches’ overhead, often offer fewer fees and better rates.

- Accessibility & tools: Manage your finances anywhere with internet access, and benefit from integrated budgeting tools and resources.

Tips to Avoid Overdrafting Your Account

Overdraft fees, while sometimes avoidable with the right checking account, can still be a hassle. The best strategy is to prevent overdrafts from occurring in the first place. Here’s how:

1. Watch your account balances

Check your accounts regularly to make sure your balances aren’t too low. If your bank has a mobile app, you can see your balance at any time.

2. Set up alerts for low balances

If your bank or credit union offers to email you or send you a text alert when your balance is low, take advantage of it.

3. Use cash for all purchases

It’s certainly not convenient to go to the bank and withdraw cash every time you need to spend money.

To get around doing this, take out as much money as you can and leave just enough to pay your mortgage, car payment, and monthly bills. Take just enough cash with you when you go out, and leave your debit and credit cards at home.

This way, your budget is a very real one. If you go over, you can’t pay for what you’re trying to purchase. It’s not stressful; it’s practical. Use your phone as a calculator, know your state’s sales tax, and you’ll be just fine.

4. Use a prepaid debit card

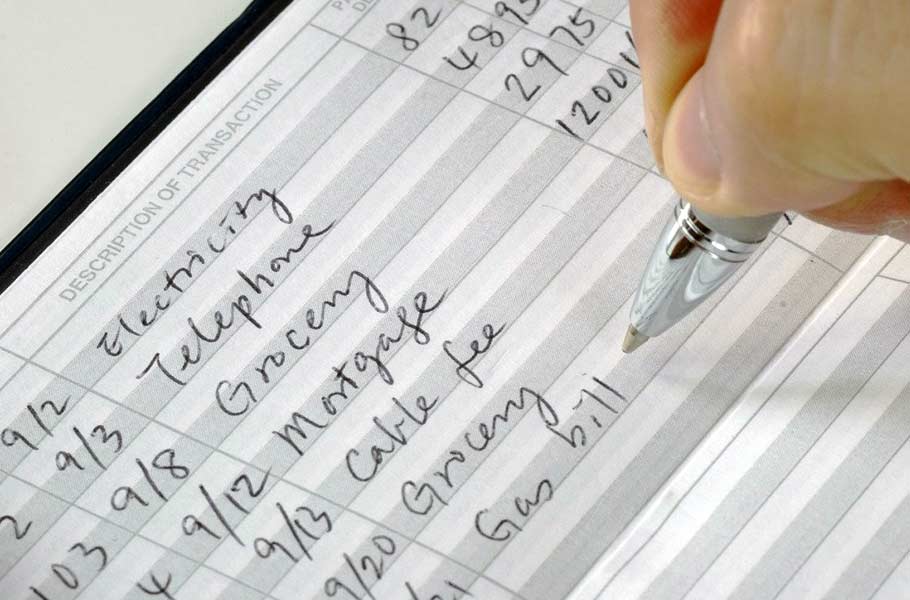

This is basically the same as using cash, but you have the added security that comes with a debit card. If you use a prepaid debit card, monitor how much you have on the card by using a transaction register.

5. Keep track of all purchases and payments

This sounds simple, but it’s actually a powerful method to stay on top of your finances.

If you would rather not use your bank’s mobile app, you can write down every transaction in your register. If you always know how much money you have, you are less likely to waste it on small purchases.

You can also use a mobile app for budgeting to do this automatically. However, if you’re just starting out, you may want to track your everyday expenses manually before using your phone.

Frequently Asked Questions

What are overdraft fees?

Most banks charge you an overdraft fee when you withdraw or spend more money from your checking account than you have. Overdraft fees vary by bank, but having a negative balance will usually cost you around $35 per transaction.

Banks and credit unions make billions of dollars in overdraft and nonsufficient funds fees every year. Fortunately, paying overdraft and nonsufficient funds fees is now optional. You can choose to completely avoid them by choosing the right checking account.

Which banks have no overdraft fees?

Banks like Capital One, Ally, Discover, and Chase (Secure Banking) offer checking accounts with no overdraft fees. Fintechs like Chime and Current also let you overdraw small amounts with no penalties.

More banks are dropping overdraft fees as customers—especially younger ones—demand fairer banking. Just check the terms, since some accounts have limits or conditions.

Are overdraft fees charged immediately?

If you have a checking account from a bank that charges overdraft fees, you usually have 5 to 7 days to fix your negative balance before you’re charged. However, thereafter, some banks charge overdraft fees every day your account is negative.

Some banks allow you to connect your checking account to your savings or money market account to cover overdrafts. If you overdraft your checking, they will pull from your savings account to cover the overdraft.

How many overdraft fees can you get charged in a day?

There are no laws that specify a maximum number of fees that banks can charge for overdrafts. Each bank and credit union has its own limit on the number of overdraft fees it will charge in one day.

Most banks charge a maximum of 4 to 6 overdraft fees per day per account. However, some allow as many as 12 in one day.

Can I get overdraft fees waived?

Some banks will waive one overdraft fee per year as a courtesy. If overdrafting is something that you rarely do, contact your bank’s customer service to ask if they will waive it. However, if you do it frequently, it may be time to get a checking account with no overdraft fees or set up overdraft protection.

How can I avoid overdraft fees?

The best way to avoid overdraft fees is by getting a checking account that doesn’t have overdraft fees like the ones we listed above. However, if you are unable to switch to a fee-free checking account, there are a few other strategies that you can employ.

You can set up low balance notifications on your account and receive alerts when it drops below a certain threshold – this way, you can easily monitor your funds and keep tabs on potential overspending.

Linking your checking account to a savings account or line of credit is another choice, which serves as a financial safety net in the unlikely event of an overdraft. Finally, establish the habit of regularly monitoring your balances and avoiding impulsive purchases. That way, all necessary expenses will always be taken care of without incurring any fees.

What is overdraft protection?

Overdraft protection is a service offered by banks that ensures your transactions are covered if you have insufficient funds in your checking account. The bank will automatically move funds you have available in a linked savings account, to the overdrawn account.

You may still incur a fee for the transfer from your linked account, but it’s usually less than the overdraft fee.