A foreclosure is one of the hardest financial setbacks you can face. Losing a home is stressful enough, but the impact on your credit makes recovery even tougher.

A foreclosure lowers your credit scores, raises borrowing costs, and can even affect things like renting an apartment or setting up utilities. While the damage lasts for years, there are situations where you may be able to get it removed from your credit reports.

How a Foreclosure Affects Your Credit

A foreclosure begins when you fall behind on your mortgage payments for at least 120 days and the lender starts legal proceedings to take back the property. Once reported to the credit bureaus, the foreclosure shows up on your credit reports and lowers your credit scores significantly.

The effect is most severe when the foreclosure is first reported. Credit scores can drop by 85 to 160 points, with the sharpest declines for people who previously had strong credit. This drop makes it difficult to qualify for loans, credit cards, or even rental housing.

How Long Does a Foreclosure Stay on Your Credit Report?

A foreclosure usually appears on your credit reports within one to two months after proceedings begin. From that point, it remains on your credit reports for seven years. The negative effect lessens as time passes, but the entry continues to lower your credit scores until it falls off.

When You Can Get a Foreclosure Deleted From Your Credit Report

Not every foreclosure can be removed, but there are situations where deletion is possible. Mortgage lenders and loan servicers often mishandled records during the housing crisis, and errors still appear on credit reports today. If you find mistakes or the lender cannot verify the account, the credit bureaus are required to delete it.

Here are common situations where removal may be possible:

- Incorrect reporting: Wrong dates, balances, account numbers, or lender names tied to the foreclosure.

- Unverifiable records: The bank that owned the mortgage loan no longer exists or cannot provide documentation.

- Servicer errors: Rushed approvals, missing paperwork, or “robo-signing” that makes the entry questionable.

- Ownership changes: Mortgages sold between banks without proper recordkeeping, leaving gaps in the paperwork.

Any foreclosure information that cannot be verified by the credit bureau must be removed under the Fair Credit Reporting Act. That is why the first step in removal is reviewing every detail carefully before sending disputes.

How to Remove a Foreclosure Step-by-Step

If you want to try removing a foreclosure on your own, there are several steps you can take before turning to professional help. Each step builds your case and increases your chances of success.

Step 1: Review Your Credit Reports for Errors

Start by pulling your free credit reports from Equifax, Experian, and TransUnion. Review every detail of the foreclosure entry, including dates, balances, account numbers, and the lender’s name. Do not assume the information is the same across all three credit bureaus.

If you spot an error, you can dispute it directly with the credit bureau. By law, they must investigate and respond within 30 days. If the lender cannot verify the foreclosure, the credit bureau must delete it.

Step 2: Dispute the Foreclosure With the Credit Bureaus

Even if the entry looks correct, you can still file a dispute if you believe the record is inaccurate or unverifiable. Write a clear dispute letter explaining why the foreclosure should be removed. Keep your tone professional and include copies of any supporting documents.

The Fair Credit Reporting Act requires the credit bureau to investigate and either fix, update, or remove the entry. If they cannot verify the foreclosure, it must be deleted.

Step 3: Contact Your Mortgage Lender Directly

If the credit bureaus do not remove the foreclosure, contact your lender in writing. Request that they remove the foreclosure from your credit reports due to inaccuracies and set a 30-day deadline for a response. Some lenders choose to remove entries they cannot verify or no longer have the records to support.

Step 4: Consider Professional Credit Repair Help

Removing a foreclosure can be difficult, especially if the credit bureaus classify your dispute as “frivolous.” Credit repair companies have experience writing disputes and working within the rules of the Fair Credit Reporting Act.

A reputable service like Credit Saint can handle the process for you. They even offer a 90-day money-back guarantee. If you are struggling to get results on your own, professional help gives you the best chance of having the foreclosure deleted.

Ready to Fix Your Credit? Start Here.

Answer a few simple questions and get a free step-by-step plan to rebuild your credit.

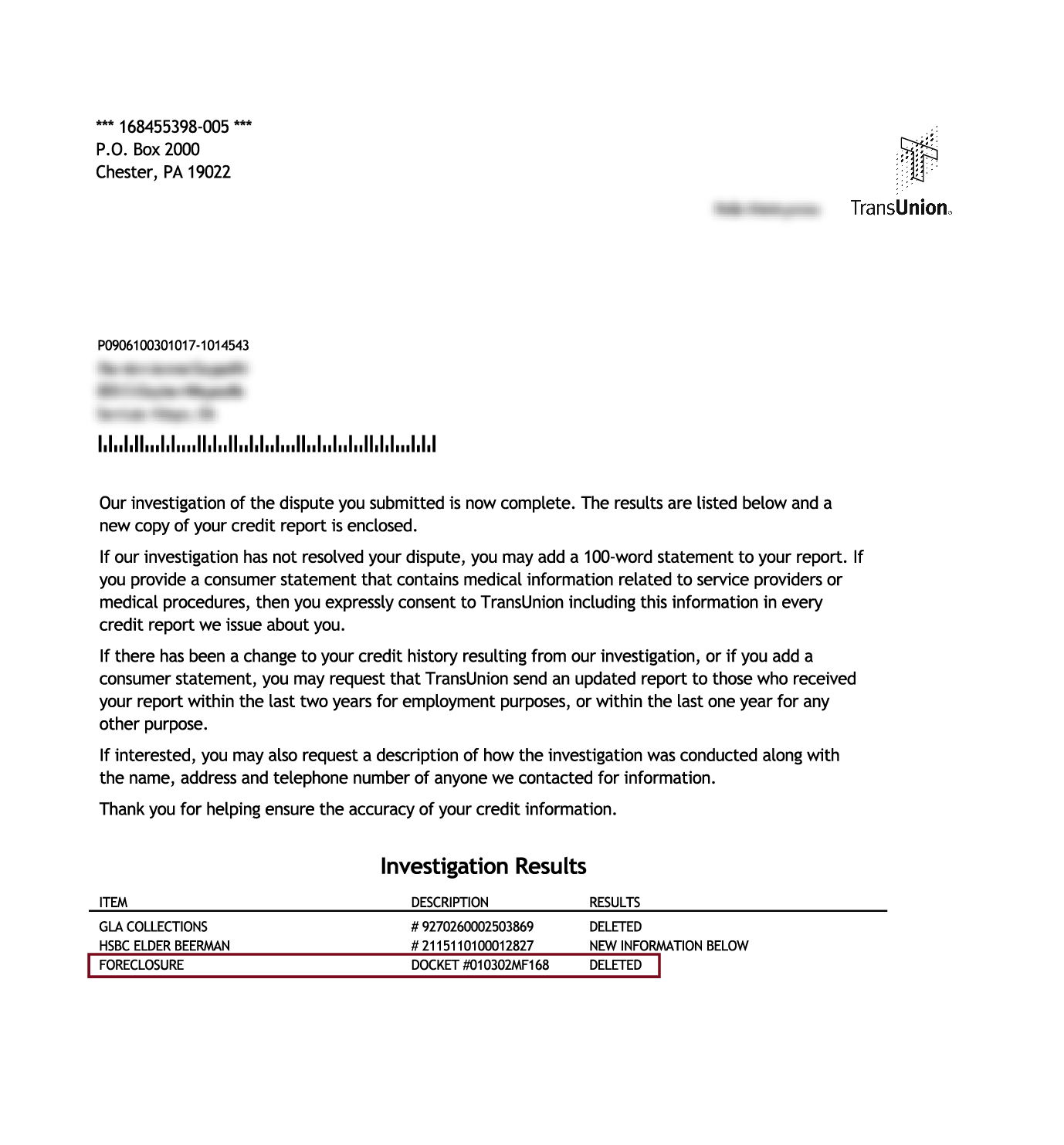

Foreclosure Removed From Credit Report

How Much Will a Foreclosure Hurt Your Credit Score?

A foreclosure can lower your credit scores by 85 to 160 points. The exact impact depends on your starting point. Someone with strong credit before foreclosure will see a larger drop than someone who already had poor or average credit.

The damage is most severe in the first two years. Over time, the impact fades, especially if you build positive credit history by paying on time, keeping balances low, and maintaining different types of credit accounts.

Can You Buy a House After a Foreclosure?

Yes, but you will face waiting periods and stricter requirements. Most lenders require at least two years before you can qualify for another mortgage, and some programs have even longer waiting times.

Here are common timelines:

- FHA loans: Eligible after three years, though exceptions exist for extenuating circumstances.

- VA loans: Eligible after two years.

- USDA loans: Eligible after three years.

- Conventional loans: Usually require a seven-year waiting period, though some allow three years with larger down payments and proof of hardship.

Even once you qualify, expect higher interest rates, stricter underwriting, and a larger down payment—often 20% or more. Rebuilding your credit during the waiting period is the best way to improve your chances of approval and reduce costs when you buy again.

Do Short Sales or Deeds-in-Lieu Affect Credit Differently?

Short sales and deeds-in-lieu of foreclosure were once seen as less damaging alternatives. Today, credit bureaus treat them the same as a foreclosure. That means they stay on your credit reports for seven years and lower your credit scores in a similar way.

The main difference is in future mortgage eligibility. Some loan programs allow borrowers who completed a short sale or deed-in-lieu to qualify sooner than those with a full foreclosure. Even so, the negative credit impact can still make approval difficult.

Here’s a quick comparison:

- Foreclosure: Seven years on credit reports, longest waiting periods for new mortgages.

- Short sale: Seven years on credit reports, some loan programs allow earlier eligibility.

- Deed-in-lieu: Seven years on credit reports, may allow earlier mortgage eligibility with proof of hardship.

Other Ways a Foreclosure Can Cost You Money

The financial impact of a foreclosure goes far beyond your credit scores. Lenders, landlords, and service providers often use credit checks to decide terms and pricing.

Here are common ways a foreclosure can create extra costs:

- Higher insurance premiums: Many insurers charge more if you have poor credit.

- Utility deposits: Gas, electric, and water companies may require large upfront deposits.

- Rental applications: Landlords may deny your application or require a bigger security deposit.

- Employment opportunities: Some employers check credit reports during the hiring process.

- Loan and credit card rates: Even if you qualify, you will likely pay higher interest.

These added costs make it harder to recover financially, which is why taking steps to rebuild your credit quickly is so important.

Final Thoughts

A foreclosure is a major setback, but it does not have to define your financial future. While it stays on your credit reports for seven years, you may be able to remove it if the entry contains errors or cannot be verified. Even if removal is not possible, the impact lessens over time as you add positive information to your credit history.

The most effective way forward is to stay current on all bills, keep your balances low, and consider professional credit repair help if you feel stuck. With consistency and patience, you can rebuild your credit and eventually qualify for better financial opportunities again.