If you rent an apartment, you’re spared the added expense of homeowners’ insurance. But even if you don’t own a house, it’s still a good idea to protect your personal property. Your landlord’s homeowner’s insurance may not cover your possessions, which means you need renters insurance.

Whether you’re a college student, a professional living in the city, or a senior who recently moved to an apartment, renters insurance gives you security. Finding the best renters insurance ensures your personal property is covered in case of theft or damage.

Top 7 Renters Insurance Companies

When selecting a renters insurance policy, it’s important to choose a company that offers comprehensive coverage, competitive pricing, and excellent customer service. We’ve researched and analyzed various options to bring you the top three renters insurance companies for 2025.

These companies stand out for their reliable policies, affordability, and positive customer feedback. By choosing one of these top-rated insurers, you can ensure that your personal property is protected and that you have the support you need in case of a claim.

1. Erie

Erie Insurance offers renters insurance with strong customer satisfaction and an A+ rating from A.M. Best. It provides comprehensive coverage with affordable pricing, though availability is limited to certain states.

2. Allstate

Allstate offers renters insurance with flexible coverage options, competitive pricing, and a strong nationwide presence. With an A+ rating from A.M. Best, it provides reliable protection and multiple discounts to lower costs.

3. State Farm

State Farm offers renters insurance with strong financial stability (A++ A.M. Best rating) and a nationwide network of local agents. Policies are affordable and come with multiple discount opportunities.

4. USAA

USAA offers renters insurance exclusively to military members, veterans, and their families. It stands out with strong financial stability (A++ A.M. Best rating) and comprehensive coverage that includes flood and earthquake protection at no extra cost.

5. Farmers

Farmers offers renters insurance with flexible coverage options and a strong reputation for customer service. With an A rating from A.M. Best, it provides reliable protection and multiple ways to customize policies.

6. Lemonade

Lemonade offers renters insurance with a fully digital experience, making it easy to get coverage and file claims through its AI-driven mobile app. With an A- rating from A.M. Best, it provides affordable pricing and fast claim processing.

7. American Family

American Family offers renters insurance with flexible coverage options and strong customer support. With an A rating from A.M. Best, it provides reliable protection and multiple discount opportunities to lower costs.

What is renters insurance?

Renters insurance policies provide coverage for unexpected situations that may arise while living in a rented property. Renters insurance typically covers three key areas: personal property, personal liability, and additional living expenses.

Personal property coverage: This aspect of a renters insurance policy covers damage or loss to your personal belongings from certain events. It’s essentially homeowners insurance for renters. It covers everything from furniture and clothes to high-value items and electronics. It’s important to note that most renters insurance policies come with coverage limits, so for expensive items, additional coverage might be needed.

Personal liability coverage: Accidents can occur in any home. If a visitor slips and falls, you could find yourself dealing with medical bills and legal costs. This coverage offers financial protection by covering such costs.

Additional living expenses coverage: In the unfortunate event your rental property becomes uninhabitable, due to a covered event like a fire, this coverage can help with the costs of finding a temporary home, meals, and other living expenses.

Renters insurance policies offer actual cash value coverage or replacement cost coverage. An actual cash value policy pays to replace your belongings, minus a deduction for depreciation. On the other hand, replacement cost coverage will reimburse you the amount it would take to buy a new, similar item at today’s prices.

Why do you need renters insurance?

Renters insurance can protect you financially after a disaster. When you purchase renters insurance, you’re covered if your property gets damaged or stolen from your home. You’ll get compensation to replace your damaged belongings if they are ruined in a fire, damaged by water (except in the case of a flood), stolen, or vandalized.

Renters insurance can also protect you from a lawsuit if someone gets injured in your home. It will cover the injured person’s medical costs, which means you don’t have to pay those fees out of pocket. It can help minimize the chances of a lawsuit. If you are sued, your insurance policy should cover your legal fees and any pay-outs to the person.

Renters insurance is usually cheaper than homeowner’s insurance, and some landlords require you to carry it. However, the cost of your premium depends on the coverage levels you select, your deductible, and any discounts on your policy.

The deductible represents the amount you’ll have to pay if you make a claim before your insurance covers the balance.

What does renters insurance cover?

Renters insurance covers most incidents that involve loss or damage to your personal property. Many insurance companies even cover your possessions while you’re traveling. That means if your laptop gets stolen from your hotel room during vacation, your belongings are covered.

Typically, renters insurance covers your property from the following hazards:

- Vehicle or aircraft damage

- Fire or smoke

- Lightning

- Volcanic eruption

- Explosion

- Theft or vandalism

- Falling objects

- Excessive weight from snow, ice, or similar elements

- Storms, including hail or wind

- Riot

- Water damage from indoor sources

Typically, insurance companies don’t cover loss or damage related to floods or earthquakes—at least not with their standard policies. To get these types of coverage, you may have to pay for add-ons.

Types of Coverage on Your Renters Insurance Policy

A typical renters insurance policy typically covers four contingencies.

- Personal property: Protects your possessions, including clothing, furniture, electronics and home appliances. The coverage applies wherever you go, except if you have items stored outside your home, such as in a storage unit. Some jewelry, fine art, or collectibles may not be covered. You can purchase a rider for these items.

- Liability: If anyone gets hurt in your home, whether they live there or not, liability coverage can save you from paying for things like medical bills or attorney fees.

- Medical payments to others: If someone who doesn’t live with you gets injured in your home, this coverage takes care of their medical expenses. However, it only covers people who live outside your home, those who live with you.

- Additional living expenses: If you have to temporarily leave your home due to damage, additional living expense coverage helps you pay for a hotel, food, and other costs.

How to File a Renters Insurance Claim

If you need to file a claim on your renters insurance policy, it’s important to follow these steps to ensure a smooth process:

1. Document the Damage or Loss

As soon as you notice damage or loss, document everything thoroughly. Take photos or videos of the affected areas and items. This evidence will be crucial for your insurance claim.

2. Contact Your Insurance Company

Notify your insurance company as soon as possible. Most companies have a specific window of time within which you must file a claim after discovering damage or loss. You can usually contact them via phone, their website, or a mobile app.

3. Fill Out Claim Forms

Your insurance company will provide you with claim forms that you’ll need to complete. Provide detailed information about the incident, including the date and time it occurred, a description of the damage or loss, and any other relevant details.

4. Provide Supporting Documentation

Along with the claim forms, submit any supporting documentation such as police reports (if the loss was due to theft), receipts for high-value items, and your inventory list of belongings. This will help the insurance adjuster assess the value of your claim accurately.

5. Work with the Adjuster

An insurance adjuster may be assigned to your case to evaluate the damage or loss. Cooperate with the adjuster, providing any additional information they request. They may visit your home to inspect the damage in person.

6. Receive Your Payout

Once your claim is approved, you’ll receive a payout according to the terms of your policy. If you have replacement cost coverage, you’ll get enough money to replace your items with new ones. If you have actual cash value coverage, you’ll receive the depreciated value of your items.

Tips for a Smooth Claims Process

- Keep a detailed inventory: Maintain an up-to-date inventory of your belongings, including photos, descriptions, and receipts. This makes it easier to prove the value of your items.

- Report promptly: Report any damage or loss to your insurance company as soon as possible to avoid delays.

- Understand your policy: Know what your policy covers and any limits or exclusions that apply. This will help you set realistic expectations for your claim.

Factors That Affect Renters Insurance Premiums

Insurance companies call the total price you pay for insurance your “premium.” Premiums vary based on your coverage levels, the area where you live, and several other factors.

Even within the same apartment building, you and your neighbor may have different coverage needs, and their policy and premiums will look different from yours.

These are just a few of the factors that can affect your rates:

- Location: If you live in a neighborhood with frequent break-ins or an area prone to hurricanes, insurance companies may consider your home a high risk.

- Deductible: Your deductible is the amount of money you pay out of pocket before the insurance covers you. A lower deductible usually means a higher premium and vice versa.

- Coverage: The more coverage you need, the higher your premium will be. For instance, someone insuring $10,000 worth of belongings will pay less than someone covering $25,000 worth of items.

- Bundles and discounts: Many renters insurance companies offer discounts or lower rates if you bundle your policies. For example, you may be able to bundle renters insurance and auto insurance.

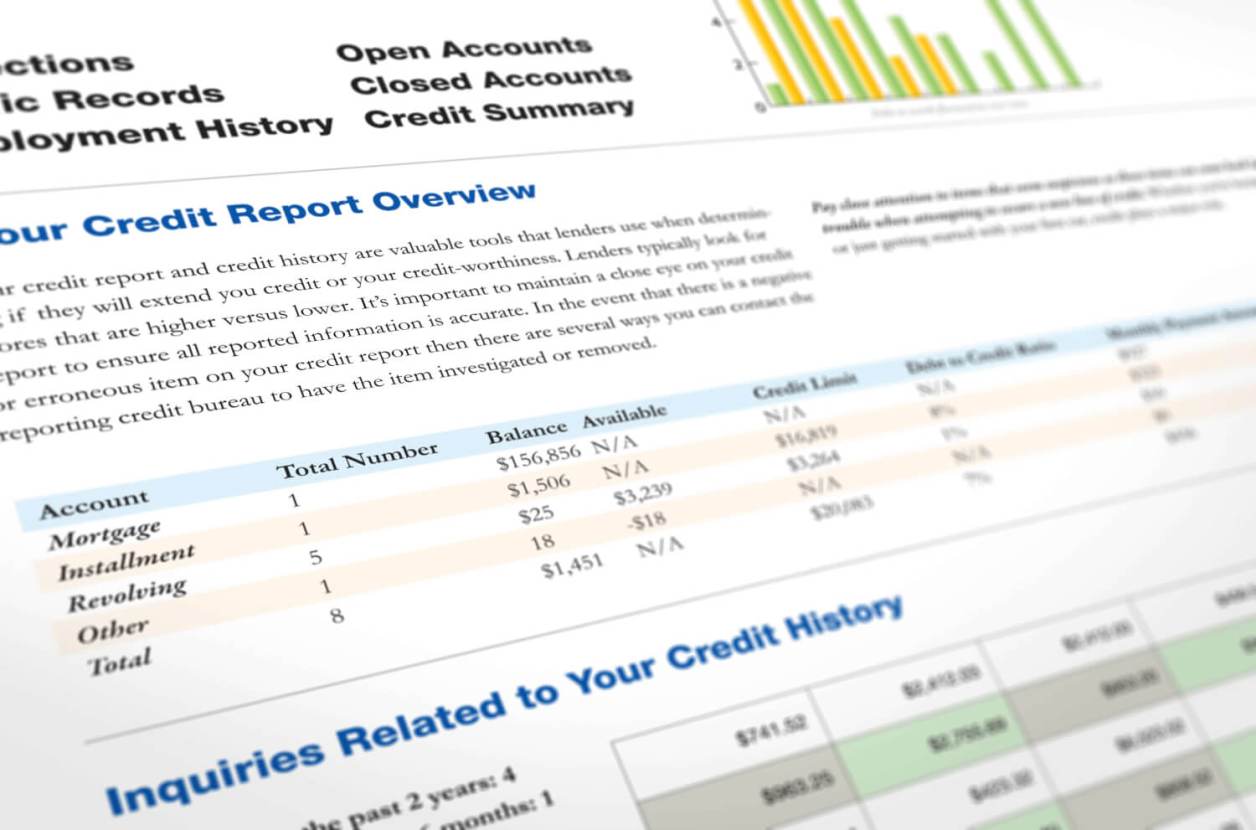

- Credit history: A high credit score implies you’re more likely to pay your premiums reliably, and you might pay less for insurance.

- Building size: A larger building or unit may mean you pay more for your coverage, as there are more items in your space. On the other hand, if you live in a tiny studio apartment, you probably don’t have as much stuff to cover.

- Security alarms, fire alarms, sprinkler systems: If your insurance provider sees that your belongings are well-protected in your home, you may pay less, as you are a lower risk.

What to Look for in a Renters Insurance Policy

When searching for the best renters insurance provider, consider what they offer and how it affects you. Consider these components if you want to get the best renters insurance:

- Coverage options: You want a company that allows you to expand your coverage if you make an expensive purchase. You may want the option to add riders for jewelry or collections.

- Price and payment options: The cheapest insurance may not give you the coverage you need. Also consider how the company accepts payment. Some will allow you to pay monthly, while others want an annual payment.

- Company reputation: Before you purchase insurance, check company reviews, as well as their rating with the Better Business Bureau. You may also want to review A.M. Best ratings, which show how financially secure the insurance company is. A company’s A.M. Best rating may indicate its ability to have the cash to pay out claims.

- Service: Does the insurance company provide an easy-to-use app to make claims? Does it offer 24/7 service? Can you get a quote online? Is it possible to reach an agent by phone? Choose a company that communicates in the way you are most comfortable with and provides the level of service you expect.

How to Get a Quote and What Information You’ll Need

Renters insurance companies have streamlined their processes, so acquiring a quote is now a fairly quick and simple procedure. However, to make the process even smoother and to ensure you’re getting the most accurate quote, there’s a set of information you need to have on hand. You should also compare quotes from multiple insurance carriers to ensure you’re getting the best value.

Personal Information

Insurance companies will first require basic personal information, including your name, address, and contact details. In some instances, they might also request your Social Security number to verify your identity.

Details About Your Rental Unit

You’ll need to provide detailed information about the property you’re renting. This includes:

- The type of property you’re renting (e.g., apartment, condo, townhouse, etc.)

- The number of rooms and the square footage

- Security features of your building or home, such as alarm systems, smoke detectors, and deadbolt locks

- If the property has any potential risk factors, like a swimming pool or trampoline

The location of your rental property also impacts your renters insurance rates, as some areas may be more prone to certain types of damage or theft.

Personal Belongings Inventory

To determine how much personal property coverage you’ll need, compile a detailed inventory of your possessions. Consider everything from clothing to electronics and furniture. For high-value items like jewelry, antiques, or artwork, you might need additional coverage.

Liability Coverage

Consider how much liability coverage you’ll need. The standard renters policy typically provides $100,000 in liability insurance, but you can increase this limit if needed.

Deductible

The deductible is the amount you’ll pay out-of-pocket before your insurance coverage kicks in if you file a claim. A higher deductible can lower your monthly premium, but it also means you’ll pay more in the event of a loss.

Comparing Quotes

Once you’ve collected all this information, you can begin to gather quotes from various insurance companies. Ensure you’re comparing similar coverage levels across different companies to get an accurate sense of the best renters insurance rates.

In addition to the cost, pay close attention to the coverage options each company offers. Some may provide extra coverage or optional endorsements for specific situations, such as identity theft coverage, earthquake coverage, or flood coverage.

By diligently shopping around and comparing renters insurance quotes, you can find a policy that provides the coverage you need at a price that fits your budget.

Bottom Line

Renters insurance can provide peace of mind in the event of a fire, theft, or storm damage in your apartment at a cost of $15 to $30 per month.

Your landlord’s insurance policy will cover repairs to the apartment. However, your renters insurance will cover your belongings and pay for a place to stay while your apartment is being repaired.

Rates, coverage, and service vary among renters insurance companies, so shop around to find the best renters insurance to meet your needs.

Frequently Asked Questions

How much does renters insurance cost?

The cost of renters insurance can vary widely based on factors like location, coverage limits, and the deductible you choose. On average, it can range from $15 to $30 per month. For those looking for cheap renters insurance, be sure to shop around and get multiple quotes to find the best deal for your needs.

What is not covered by renters insurance?

Renters insurance typically won’t cover natural disasters like floods or earthquakes. For that, you’d need to buy additional coverage. It also won’t cover damage caused by pests such as rodents or bugs.

Is renters insurance mandatory?

Renters insurance is generally not required by law, but it’s common for landlords to require it as part of your lease terms to protect their property and minimize their own liability.

How quickly can I make a claim after purchasing renters insurance?

You’re usually able to file a claim as soon as your policy becomes active. However, for some types of coverage, there might be a brief waiting period before you’re eligible to make a claim.

Does renters insurance cover roommates?

A standard renters insurance policy usually covers only the person who has taken out the policy. If you have roommates, they would need to be specifically named in the policy to be covered.

Can I adjust my coverage limits after the policy is active?

Yes, most insurance providers allow changes to your coverage limits even after your policy is in effect. Keep in mind that changing your limits will often change your premium cost as well.

How do I calculate the amount of personal property coverage I need?

The best approach is to make a detailed inventory of your belongings and assess their value. This will give you a clearer idea of the coverage amount you need to protect your assets.

Can I pay my premium in installments?

This depends on the company. Some offer the flexibility of monthly payments, while others might only accept an annual lump sum.

Do companies offer a discount for paying the premium upfront?

Many renters insurance companies do offer a discount if you pay your premium in one lump sum rather than in monthly installments.

How does my credit score affect my premium?

Generally, a better credit score can lead to a lower premium. Insurance companies view a higher credit score as an indicator of lower risk.

Are there any additional fees apart from the premium?

Be aware that some insurance companies may have additional fees, such as for opting for installment payments or receiving paper bills. Make sure to read the terms carefully.