In personal finance, it’s important to understand the different types of bank accounts available to manage your money effectively. Checking and savings accounts are the two most commonly used accounts. Each serves unique purposes, and understanding these can help you make more informed financial decisions.

A checking account enables you to effortlessly access your funds for everyday expenses and transactions. Meanwhile, a savings account is intended to help you save and earn interest on your hard-earned money.

Picking the appropriate account that caters to your financial needs can aid you in better money management and reaching your financial aspirations. This article dives deep into the differences between these accounts and helps you decide which one is best suited for your financial needs.

What are the main differences between a checking and a savings account?

Let’s take a look at the main differences between checking and savings accounts:

- Interest rates: A checking account generally offers lower interest rates compared to a savings account.

- Accessibility and withdrawal limits: Checking accounts provide greater accessibility and fewer withdrawal restrictions as compared to savings accounts.

- Fees and charges: Checking accounts may come with more fees and charges than savings accounts.

- Intended purpose and use: Checking accounts are meant for daily transactions and expenses, while savings accounts are meant for saving and earning interest on your money.

Checking Accounts: An Overview

What is a checking account?

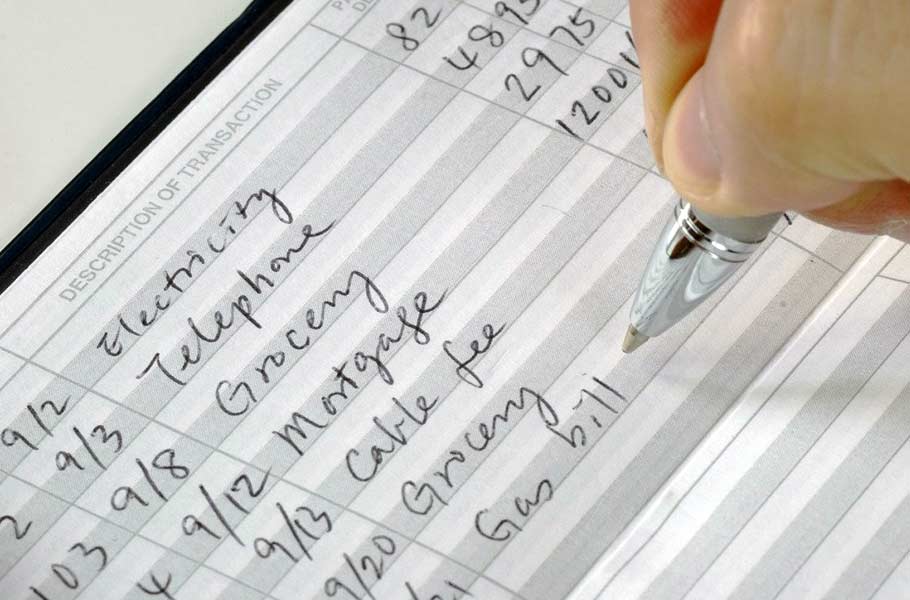

A checking account is a type of bank account that allows you to deposit money, write checks, and make electronic transfers. It’s a demand deposit account that typically includes features such as debit cards, online banking, and mobile banking capabilities. Checking accounts are intended for everyday transactions, like paying bills, making purchases, and accepting direct deposits.

How to choose a checking account

Choosing the right checking account can assist you in better money management and reduce costs related to fees. Here’s a concise guide on how to pick the ideal checking account for your needs:

- Look for a checking account that does not impose a monthly maintenance fee, or has a straightforward process to waive it.

- Consider accounts that offer free access to a vast ATM network, along with sign-up bonuses.

- Ensure the account provides a standard debit card for seamless everyday purchases.

- Thoroughly examine the details and be aware of any other fees linked to the account before deciding.

- Look for accounts that offer overdraft protection or have no overdraft fees.

Check out our picks for the best checking accounts.

Common transactions made with a checking account

Here are a few examples of the types of transactions that can typically be made with a checking account:

- Paying bills online or by mail

- Debit card purchases

- Withdrawing cash from an ATM

- Depositing paychecks via direct deposit

- Writing checks to pay for goods or services

- Making online transfers to other bank accounts

Types of Checking Accounts

There are several types of checking accounts, each designed to cater to different needs and preferences. Understanding the various options can help you choose the best account for your financial situation.

Basic Checking

A basic checking account is the most common and straightforward type of checking account. They typically come with a low or no monthly maintenance fee and a small minimum balance requirement. Basic checking accounts are ideal for those who need a simple account for everyday transactions and don’t require additional features or perks.

Interest Checking

An interest checking account earns interest on the account balance, providing an additional way to grow your money. These accounts usually have a higher minimum balance requirement to earn interest. If you maintain a significant balance in your checking account, an interest checking account can help you earn a return on your funds while still having easy access to your money.

Student Checking

A student checking account is designed specifically for students and generally offers no or low fees, as well as lower balance requirements. These accounts may also come with additional benefits such as discounted banking services or financial education resources. Student checking accounts are ideal for young adults who are just starting to manage their finances and need a low-cost, easy-to-use account.

Senior Checking

A senior checking account caters to the needs of older adults, typically offering lower fees and minimum balance requirements. These accounts may also provide additional benefits, such as discounted checks or free financial planning services. Senior checking accounts are suitable for retirees or those nearing retirement who want a low-cost account with added benefits.

Premium Checking

Premium checking accounts come with a range of features and perks, such as free checkbooks, ATM fee waivers, higher interest rates, and other benefits. However, these accounts also typically have higher fees and minimum balance requirements. Premium checking accounts are best suited for individuals who maintain a high balance in their account and can take advantage of the additional features and benefits.

Online Checking

Online checking accounts are offered by online-only banks, which can afford to provide low or no monthly maintenance fees and no balance requirements due to lower overhead costs. These accounts often come with user-friendly digital tools and may offer higher interest rates compared to a traditional checking account. Online checking accounts are ideal for tech-savvy individuals who prefer to manage their finances online and want a low-cost, convenient account.

Second Chance Checking

Second chance checking accounts are designed for customers who have had past banking issues, such as negative records in ChexSystems or credit problems. These accounts typically have higher fees and may require direct deposit. A second chance checking account offers an opportunity for individuals to rebuild their banking history and work toward better financial management.

Savings Accounts: An Overview

What is a savings account?

A savings account is a type of bank account that is designed for saving money and earning interest on those savings. This type of account usually provides higher interest rates than checking accounts, and comes with specific withdrawal restrictions. Some savings accounts also offer additional perks, such as online banking and mobile banking.

How to choose a savings account

Knowing what factors to examine when selecting a savings account can speed up your journey to reach financial goals. Here are some elements to consider when choosing a savings account:

- Search for a savings account that offers the highest annual percentage yield (APY) possible.

- Evaluate the fees of different banks and credit unions. Consider opening a savings account with an online bank, as they often offer superior interest rates.

- Review the account’s minimum deposit requirement, and look for accounts with a lower requirement or no requirement at all.

- Examine the account’s withdrawal and transfer restrictions, to guarantee they are consistent with your savings objectives.

Take a look at our picks for the best savings accounts.

Common transactions made with a savings account

- Depositing money for long-term savings goals or emergency funds

- Withdrawing money from the account, subject to withdrawal limits

- Monitoring account balance and transaction history

- Setting up automatic transfers from a checking account to a savings account

- Setting up direct deposit to the savings account

- Earning interest on the balance in the account

Types of Savings Accounts

In addition to a traditional savings account, there are several other types of savings accounts available to help you achieve your financial goals. Each type of savings account has its unique features, advantages, and limitations. Here are some common types of savings accounts:

High-Yield Savings Accounts

A high-yield savings account offers significantly higher interest rates compared to a traditional savings account. They are often available through online banks, which can afford to offer higher rates due to lower overhead costs. High-yield savings accounts are a great option for those looking to maximize their savings growth without taking on additional risk.

Here’s a list of the best available high-yield savings accounts for 2025.

Joint Savings Accounts

A joint savings account is a savings account shared by two or more individuals, typically spouses or family members. Joint account holders have equal access to the account and can manage the funds together. This type of account is ideal for couples or families who want to save together for shared financial goals or expenses.

Custodial Savings Accounts (UGMA/UTMA Accounts)

A custodial savings account, also known as Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) accounts, are designed for adults to save on behalf of a minor. These accounts are managed by a custodian (usually a parent or guardian) until the minor reaches the age of majority (typically 18 or 21, depending on the state). Custodial accounts can be used to save for a child’s education, future expenses, or to teach them about financial responsibility.

Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a tax-advantaged savings account specifically designed for individuals with high-deductible health plans (HDHPs). Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free. HSAs are an excellent way to save for healthcare costs while also benefiting from tax advantages.

Individual Development Accounts (IDAs)

An Individual Development Account (IDA) is a matched savings account designed to help low-income individuals save for specific purposes, such as buying a home, starting a business, or pursuing higher education. Nonprofit organizations and government agencies typically sponsor IDAs, which provide matching funds to encourage participants to save.

Goal-Oriented Savings Accounts

Some banks and credit unions offer a goal-oriented savings account designed to help account holders save for specific goals, such as buying a car, going on vacation, or creating an emergency fund. These accounts may include features such as automatic transfers, milestone rewards, or built-in savings trackers to help keep savers motivated and on track.

Other Types of Savings Accounts

Certificates of deposit (CDs) and money market accounts both offer the potential for a higher return on your money compared to traditional savings accounts.

Certificates of Deposit (CDs)

A CD is a deposit account that provides a fixed interest rate for a set term, such as 6 months or a year. It is perfect for those seeking guaranteed returns and who don’t need access to their funds during the term. Keep in mind that withdrawing funds from a CD before its maturity date may result in penalties.

Money Market Accounts

A money market account, similar to a savings account, often offers higher interest rates and the ability to write checks. It is a low-risk investment option insured by the FDIC, making it suitable for those seeking higher returns than a savings account and the ability to access their funds with ease. However, money market accounts may have higher minimum balance requirements and withdrawal restrictions.

Both CD and money market accounts can be great for growing your money over time, but you should compare rates and understand the differences before choosing one over the other.

Final Thoughts

When it comes to managing your finances, understanding the differences between savings and checking accounts is essential for making informed decisions. By learning about the various types of accounts, their features, and their intended uses, you’ll be better equipped to manage your money effectively and reach your financial goals.

To maximize the potential of your finances, it may be beneficial to open both a checking account and a savings account. Always take the time to research and compare different accounts to ensure that you’re making the best choice for your unique financial situation.

Frequently Asked Questions

Can I have both a checking and a savings account at the same bank?

Yes, you can have both a checking and a savings account at the same bank. Many banks encourage this by offering package deals or linked accounts, which can make managing finances more convenient.

Is my money safe in checking and savings accounts?

When depositing money at a bank or credit union, safety is generally assured through FDIC or NCUA insurance.

The Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA) will reimburse depositors for their insured deposits in case of an institution failure. The deposit insurance covers up to $250,000 per depositor per institution.

Always research the financial stability of the bank or credit union before depositing a substantial amount.

How often can I withdraw money from my checking and savings accounts?

Withdrawals from Checking Accounts:

- Frequency: Generally, there are no limits on the number of withdrawals or transfers you can make from a checking account. This includes ATM withdrawals, debit card purchases, check transactions, and electronic transfers.

- Purpose: Checking accounts are designed for frequent transactions, making them suitable for daily expenses like bill payments, shopping, and receiving direct deposits.

Withdrawals from Savings Accounts:

- Frequency: Savings accounts, traditionally, were subject to Regulation D, which limited certain types of withdrawals and transfers to six per month. However, this rule was suspended in April 2020 by the Federal Reserve, giving banks the discretion to set their own limits.

- Purpose: Savings accounts are intended for less frequent transactions, focusing on saving money. Exceeding the set withdrawal limits (if imposed by the bank) can result in fees, or in some cases, the account being converted to a different type.

Are there any benefits to having multiple savings or checking accounts?

Yes, having multiple accounts can be beneficial for separating finances for different purposes, such as savings for emergencies, vacations, or large purchases. It can also help in budgeting and tracking specific expenses more effectively.

Can I write checks with a savings account?

No, typically you cannot write checks with a savings account. Savings accounts are designed for saving funds and earning interest, and they generally do not offer check-writing capabilities. For writing checks, a checking account would be the appropriate choice.

How can I tell if my bank account is a checking or savings account?

To determine if your account is a checking or savings account, consider the account’s features and services. Checking accounts generally offer check-writing capabilities and a debit card for daily transactions, with fewer restrictions on withdrawals and deposits.

In contrast, savings accounts typically earn higher interest, have withdrawal limits, and do not provide check-writing facilities. Your bank statements or online banking portal will usually clearly label the account type. If you’re still unsure, contacting your bank directly is the best way to clarify.

Are there any benefits to using a debit card instead of a credit card?

Debit cards offer several advantages over credit cards. They provide direct access to your own funds, reducing the likelihood of accruing debt, as you can only spend what is available in your account. This encourages disciplined spending, a contrast to credit cards which can tempt overspending.

Debit cards typically involve fewer fees and no interest charges compared to credit cards. They also offer the convenience of wide acceptance and simplify tracking expenses through bank statements.