Imagine this: It’s the end of the month and your car suddenly needs a $300 repair. Your bank balance is near zero, your credit cards are maxed out, and payday is still a week away. What do you do?

For millions of Americans, the answer is a payday loan. About 12 million people turn to them each year for quick cash—but these short-term loans come at a steep price. They’re fast and easy to get, but the interest rates are sky-high and can trap you in a cycle of debt.

Before taking one out, it’s important to understand exactly how payday loans work, who qualifies, and what the risks are. In this guide, we’ll cover the pros and cons, explain your alternatives, and help you decide whether a payday loan is really worth it.

What is a payday loan, and how does it work?

A payday loan is a short-term loan, usually for $100 to $1,000, that’s meant to be paid back with your next paycheck. These loans are often used to cover urgent expenses—like rent, car repairs, or medical bills—when you’re out of cash and out of options.

You don’t need good credit to get a payday loan. In fact, most lenders won’t check your credit at all. But the catch is the high cost. You’ll typically pay $15 to $30 in fees for every $100 you borrow. That may not sound like much, but it adds up fast—especially if you can’t pay it back on time.

Here’s how it works:

- You apply online or in person.

- You write a postdated check or give the lender access to your bank account.

- On your due date—usually in two weeks—the lender cashes the check or withdraws the money.

If the funds aren’t there, you might be able to roll over the loan, but you’ll have to pay another fee. That’s how people end up stuck paying hundreds in fees on a loan they only needed for a few days.

Who qualifies for a payday loan?

Payday lenders don’t care about your credit score, but they do have a few basic requirements.

- State laws: You must live in a state where payday loans are legal. Some states have banned them entirely.

- Income: You need a steady source of income. This can be a job, government benefits, or any other regular payment.

- Age: You must be at least 18 years old, or 21 in some states.

- Bank account: You’ll need an active checking account, since most lenders withdraw the repayment directly.

- ID and contact info: Expect to provide your Social Security number, phone number, and sometimes proof of income like pay stubs or benefit letters.

The application process is usually quick. Many lenders can approve your loan within minutes, and you may receive the funds on the same day.

Pros & Cons of Payday Loans

Payday loans can be helpful in the right situation, but they come with serious risks. Here’s a quick overview:

Pros

- Fast access to cash: You can often get the money the same day you apply.

- No credit check: Lenders don’t check your credit during the application process. Bad credit or no credit isn’t a barrier.

- Easy approval process: Basic documentation and proof of income are usually enough.

- No collateral required: These are unsecured loans—you don’t have to put anything on the line.

Cons

- Extremely high fees: You’ll often pay $15–$30 per $100 borrowed, which can translate to an annual percentage rate over 300%.

- Short repayment window: Most loans are due in two weeks, which isn’t enough time for many borrowers.

- Debt cycle risk: Rolling over loans leads to more fees and can trap you in long-term debt.

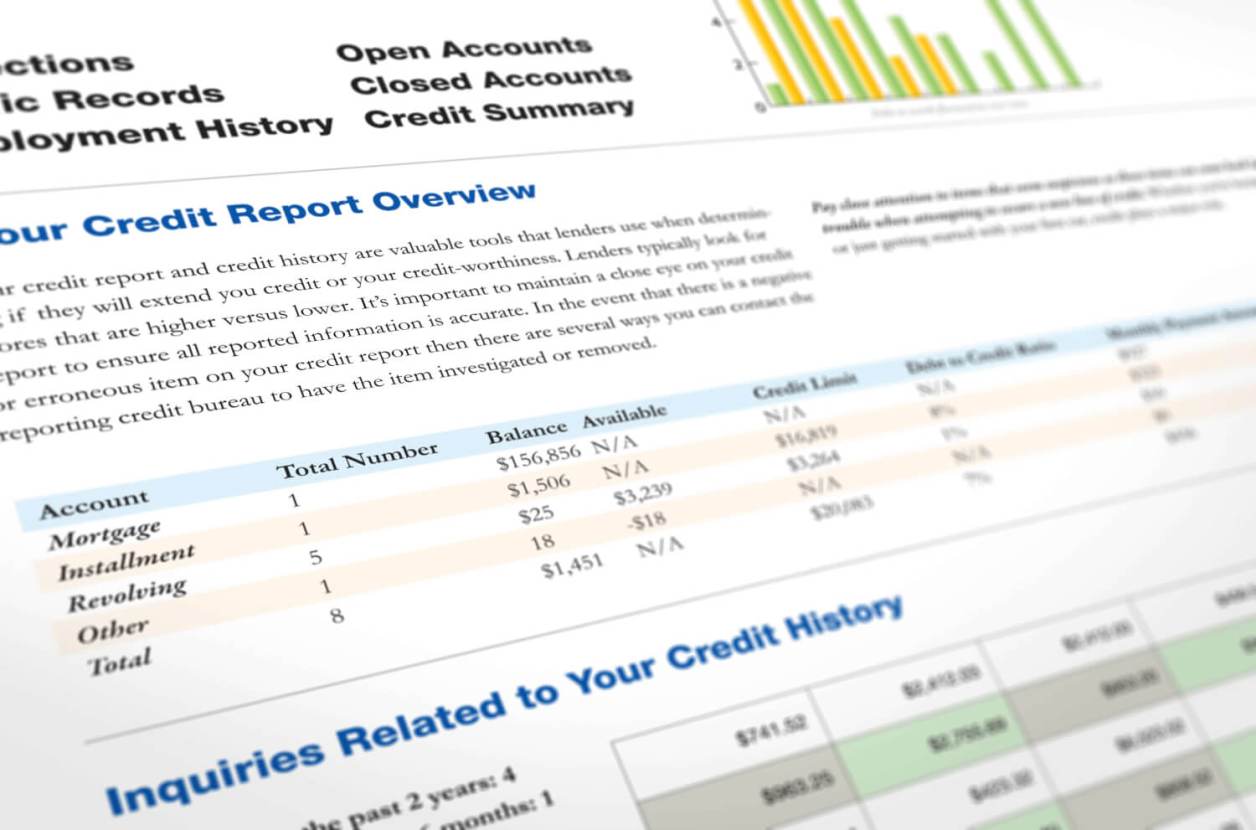

- No credit benefit: Even if you repay on time, lenders typically don’t report it to credit bureaus, so it won’t help your credit score.

Payday loans are built for convenience, not sustainability. If you’re not 100% sure you can pay it back on time, the risks may outweigh the benefits.

The Hidden Costs of Payday Loans

Payday loans may seem simple, but the real cost goes far beyond the loan amount. If you’re not careful, fees can pile up fast—often leaving you worse off than before.

Here’s what to watch out for:

- High APRs: The fees might look small, but they usually translate to annual percentage rates over 300%. For example, a $15 fee on a $100 loan equals a 391% APR if repaid in two weeks.

- Rollovers and renewals: If you can’t repay the full loan by the due date, lenders often offer to “roll it over” into a new loan. Each time, you pay another fee.

- Debt cycle trap: Many borrowers end up taking out new payday loans just to cover the old ones. According to the Consumer Financial Protection Bureau, most payday loans are reborrowed within a month.

What seems like a quick fix can turn into long-term debt that’s hard to escape.

Payday Loan Risks and State Regulations

Payday loans are regulated by each state, and the rules can be drastically different depending on where you live. Some states have banned them completely. Others allow them but limit how much you can borrow, how long you have to repay, or how much interest a lender can charge.

Payday Loan Regulations by State

- Banned states: Payday loans are illegal in places like Georgia, North Carolina, and New York.

- Strict limits: Some states cap interest rates or restrict loan amounts—usually between $300 and $1,000.

- Looser rules: Other states have longer loan terms and fewer restrictions, which can raise the risk of falling into a debt cycle.

To see what’s allowed in your state, check with your state’s financial regulator.

Smarter Alternatives to Payday Loans for Bad Credit

If you have bad credit and need fast cash, payday loans aren’t your only option. Here are safer alternatives that can help you get back on track—without the massive fees.

- Payday alternative loans (PALs): Offered by credit unions, PALs provide small-dollar loans with lower fees and longer repayment terms.

- Credit builder loans: These loans help improve your credit score while giving you access to small amounts of money.

- Credit union personal loans: Many credit unions are willing to lend to members with poor credit at much lower rates.

- Secured loans: Secured loans use collateral like a car or savings account to qualify for better loan terms.

- Online lenders for bad credit: Some online lenders specialize in personal loans for borrowers with low credit scores.

- Peer-to-peer lending: P2P lending platforms connect you with individual investors instead of traditional financial institutions.

For more ideas, check out our guide to the best payday loan alternatives.

How to Avoid Payday Loans in the Future

Avoiding payday loans isn’t just about saying no—it’s about building a financial plan that helps you stay ahead. Here’s how to do that:

- Build an emergency fund: Even $10 a week adds up over time and can give you a safety net.

- Create a simple budget: Track your income and spending to spot areas where you can cut back and save.

- Ask for help: Consider borrowing from friends, family, or local community resources before turning to a payday lender.

- Negotiate bills: Call your creditors or utility providers and ask about hardship programs or payment plans.

- Boost your income: Look into a side hustle, gig work, or part-time opportunities to add extra cash flow.

- Improve your credit score: With better credit, you’ll have access to lower-cost borrowing options in the future.

A little planning today can save you hundreds in fees tomorrow.

Final Thoughts

Payday loans can feel like a quick solution when money is tight, but the costs add up fast—and the risks are real. They’re easy to get into and hard to get out of, especially if you can’t repay them right away.

Before taking out a payday loan, make sure you’ve explored every other option. Look at safer loan alternatives, talk to a credit union, or reach out to a nonprofit credit counselor. And if you’ve already taken one out, focus on breaking the cycle, rebuilding your credit, and creating a plan to stay ahead of future expenses.

Fast money isn’t worth it if it sets you back even further.

Frequently Asked Questions

Are online payday loans safe?

Online payday loans can be safe, but it’s essential to research the lender thoroughly. Be cautious of online lenders who don’t require any credit checks or who promise guaranteed approval, as these might be red flags for potential scams.

How can I identify a reputable payday lender?

A reputable payday lender will be licensed and comply with state regulations. They should transparently disclose all fees, interest rates, and terms of the loan. Check for reviews and ratings, and consider consulting your state’s financial regulatory agency.

What happens if I can’t repay a payday loan on time?

Failing to repay a payday loan on time can lead to additional fees and increased interest rates, exacerbating the borrower’s financial situation. It might also negatively impact your credit score and result in debt collection efforts.

Can I extend or refinance a payday loan if needed?

Yes, many payday lenders allow borrowers to extend or refinance their loans. However, this often comes with additional fees and can significantly increase the total cost of the loan, trapping borrowers in a cycle of debt.