Lenders look at more than just your payment history and total debt when evaluating your credit score. The types of credit accounts you have—known as your credit mix—play a role, too. While this factor only makes up 10% of your FICO score, it can still influence how creditors view you as a borrower.

Having a well-rounded credit profile can show lenders that you can manage different types of credit responsibly. For example, someone with only credit cards may be seen as a higher risk compared to someone who has successfully handled both credit cards and loans. But does that mean you should take on debt just to improve your credit mix? Not necessarily.

This guide breaks down the three types of credit accounts, how they impact your score, and how to improve your credit mix without taking on unnecessary debt.

What is credit mix, and why does it matter?

Credit mix isn’t the first thing people focus on when trying to improve their credit score, but it still plays a role. Lenders don’t just want to see that you pay your bills on time—they want to see how well you handle different types of credit.

For someone with a long credit history and solid payment habits, credit mix might not move the needle much. But if you’re just starting out or rebuilding after past mistakes, having a variety of account types can help show you’re a responsible borrower.

For example, someone who’s only used credit cards might look riskier to lenders than someone who’s also managed a personal loan. On the other hand, having only loans and no credit card history could raise concerns about how you’d handle revolving credit.

It’s not something you need to force—credit mix tends to improve naturally with time and responsible use.

How Different Types of Credit Accounts Affect Your Credit Score

Lenders don’t just look at whether you pay your bills on time—they also consider the types of accounts you have. Credit mix helps them evaluate how well you manage different kinds of debt. A borrower with a combination of credit cards and loans may appear more financially stable than someone with only one type of credit.

Credit mix plays a bigger role when lenders can’t rely on a long credit history to assess risk. If you’ve only ever had credit cards, they don’t know how you would handle a fixed loan payment. On the other hand, if you’ve only had loans, they don’t know if you can responsibly manage a revolving credit line. A lack of variety could make lenders hesitate, especially if your credit history is limited.

Having multiple types of credit doesn’t mean your score will automatically be higher. A well-managed credit card account is better than having a mix of accounts with late payments or high balances. The key is maintaining a healthy balance between installment loans and revolving credit while keeping debt under control.

Types of Credit Accounts That Shape Your Credit Score

Credit accounts fall into three main categories: revolving, installment, and open. Each type affects your credit score differently, and having a mix of them can help show lenders that you can manage various forms of debt responsibly.

Revolving Credit

Revolving credit allows you to borrow up to a set limit, repay what you owe, and borrow again without having to reapply. The most common example is a credit card, but home equity lines of credit (HELOCs) and store credit cards also fall into this category.

Store credit cards are issued by specific retailers and can usually only be used at those stores. They tend to have lower credit limits and higher interest rates than general-purpose credit cards, which makes it easier to rack up a high utilization rate. But if used carefully and paid off in full each month, they can still help build credit history and contribute to your credit mix.

Revolving accounts have a significant impact on your credit score because of credit utilization, which measures how much of your available credit you’re using. Keeping your balances low compared to your limits can help improve your credit score. Carrying high balances, on the other hand, can signal financial risk to lenders.

Installment Credit

Installment credit includes loans that have a fixed payment schedule and a set repayment term. Mortgages, car loans, student loans, and personal loans all fall into this category. Unlike revolving credit, you can’t borrow more once the loan is issued—you must repay it in full over time.

These accounts help build a strong payment history, which is the most important factor in your credit score. Making on-time payments consistently shows lenders that you can handle debt responsibly. Installment loans also contribute to your credit mix, but they don’t impact your credit utilization the way revolving credit does.

Open Credit

Open credit accounts are accounts where you must pay the full balance each month. There’s no option to carry a balance, and there’s no fixed loan term. These accounts don’t show up as often on your credit report, but they can still affect your score depending on the type.

Charge Cards

Some credit cards—especially charge cards like the American Express Green or Gold—require you to pay the full balance every month. These are different from traditional credit cards and are considered open credit by credit scoring models. Charge cards are reported to the credit bureaus and can help your credit mix if managed well.

Utility and Cell Phone Bills

While utility bills and cell phone plans also require monthly payments, they usually don’t show up on your credit report unless something goes wrong. If you fall behind and the account goes to collections, it can damage your credit score.

Some services, like Experian Boost, let you add on-time utility and phone payments to your credit report, but this only affects certain credit scoring models—not all lenders will see it.

How to Build a Strong Credit Mix Without Taking on More Debt

As mentioned earlier, you don’t need to take on debt just to improve your credit mix. But if you’re looking to round out your credit profile in a smart, low-risk way, there are a few options worth considering.

Credit Builder Loans

Credit builder loans are designed for people with limited credit history. You make fixed monthly payments, and the lender holds the funds in a savings account until the loan is paid off. Payments are reported to the credit bureaus, helping you build credit while adding an installment account to your report.

See also: Best Credit Builder Loans of 2026

Secured Credit Cards

If you don’t qualify for a traditional credit card, a secured card is a good entry point. It requires a refundable security deposit and functions just like a regular credit card. Responsible use helps establish revolving credit history.

See also: Best Secured Cards of 2026

Becoming an Authorized User

You can also be added to someone else’s credit card account—typically a family member or close friend. As long as the account is managed well, it can help improve your credit mix and credit age without requiring you to open a new account yourself.

These options allow you to improve your credit mix over time without putting yourself in financial risk.

Should You Close Old Credit Accounts?

Closing a credit account might seem like a good idea, especially if you no longer use it, but it can actually hurt your credit score. The decision to close an account should be made carefully, as it can affect two key factors in your credit profile: credit age and available credit.

Why Closing Accounts Can Backfire

One of the biggest risks of closing an account is reducing the length of your credit history. The average age of your accounts is an important factor in your credit score. If you close one of your oldest accounts, it can shorten your credit history and lower your score over time.

Closing an account also impacts credit utilization, which is the percentage of your available credit that you’re using. If you have multiple credit cards and close one with a high limit, your total available credit decreases while your existing balances stay the same. This can drive up your credit utilization ratio, which may negatively impact your score.

When It Might Make Sense to Close an Account

There are situations where closing an account is the right move. If a credit card has a high annual fee, and you’re not using it enough to justify the cost, closing it might make sense—though you could also consider downgrading to a no-fee version.

Another reason to close an account is if it tempts you to overspend. If keeping the card open leads to accumulating unnecessary debt, it may be better for your financial health to close it, despite the potential credit score impact.

In most cases, keeping old accounts open—even if you don’t use them regularly—can help maintain a strong credit profile. If you do decide to close an account, try to pay down existing balances on other revolving accounts to keep your credit utilization low.

Final Tips for Managing Your Credit Mix

A well-balanced credit mix can strengthen your credit profile, but it’s just one piece of the bigger credit score puzzle. The key is to manage your accounts wisely without taking on unnecessary debt.

- Avoid opening new accounts just for the sake of variety. While having a mix of credit types can be beneficial, taking out a loan or opening a credit card you don’t need can do more harm than good. Focus on responsible credit use rather than chasing a perfect mix.

- Keep old accounts open when possible. Closing older accounts can shorten your credit history and increase your credit utilization ratio. If an account has no fees and doesn’t tempt you to overspend, keeping it open can help maintain your score.

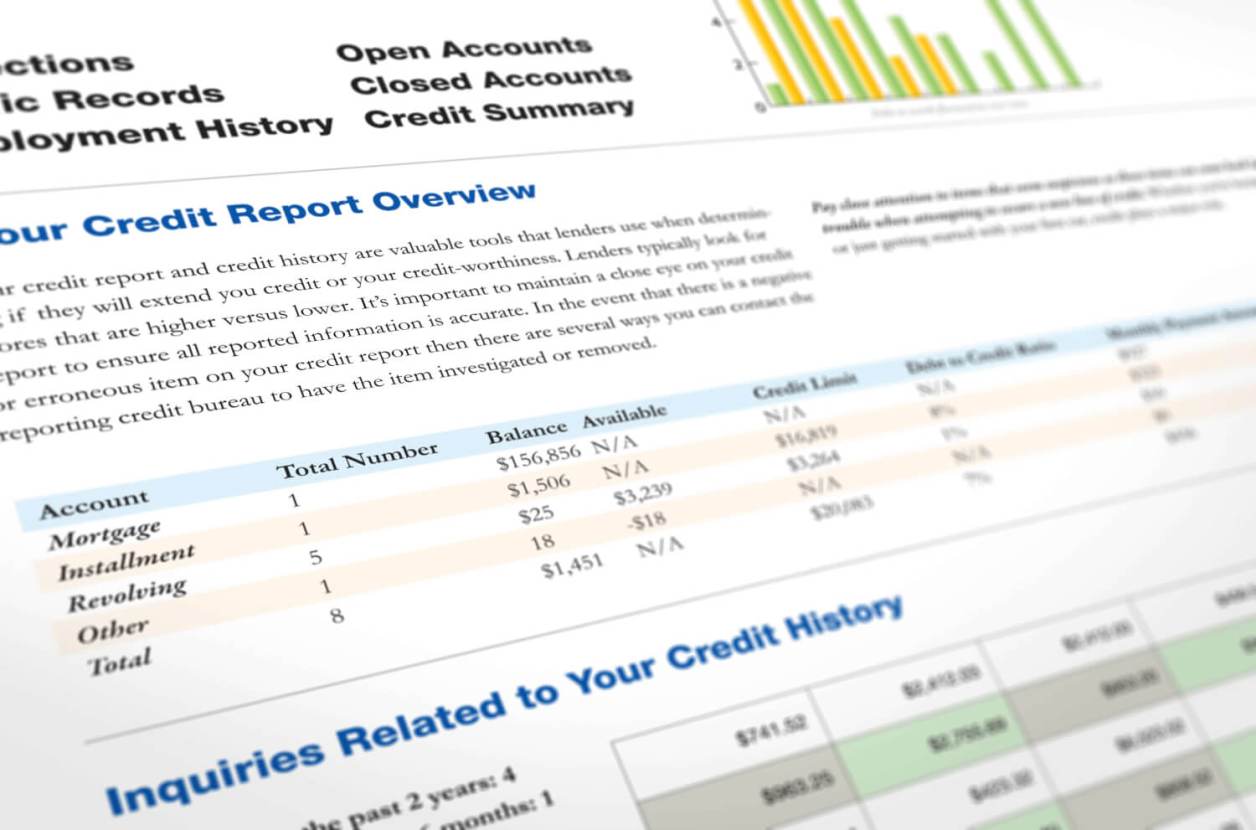

- Check your credit report regularly. Errors on your credit report can affect your score, including mistakes related to your credit mix. Reviewing your report can help you catch inaccuracies and address them before they cause problems.

See also: Do-It-Yourself Credit Repair Guide for 2026

Building and maintaining a strong credit mix happens naturally over time. The best approach is to focus on good financial habits—paying bills on time, keeping balances low, and using credit responsibly.

Conclusion

Credit mix may only account for 10% of your credit score, but it can still influence how lenders view your financial habits. A well-balanced mix of installment and revolving accounts shows that you can handle different types of credit responsibly.

While adding variety to your credit profile can help, it’s never worth taking on debt just to improve your score. Instead, focus on making smart financial decisions, keeping accounts in good standing, and maintaining a healthy balance of credit over time. By managing your credit mix wisely, you’ll put yourself in a stronger position to qualify for better lending opportunities in the future.