Direct deposit is a convenient and efficient way to receive payments, whether it be from your employer or from government benefits. However, some people don’t have bank accounts, and this can make it difficult to take advantage of direct deposit. Fortunately, there are alternative solutions that allow you to receive direct deposit without a bank account.

Alternatives to Banks and Credit Unions

Prepaid Debit Cards

One popular alternative to a having a checking account at a bank or credit union is a prepaid debit card. These cards work just like a regular debit card, but they are not linked to a traditional bank account. Instead, they are funded by the user, either through a one-time deposit or through recurring deposits.

Many prepaid debit cards also offer direct deposit capabilities, allowing you to receive your paychecks or government benefits directly onto the card. This can be a convenient option for those without a bank account, as it eliminates the need to cash a check or visit a physical location to pick up a check.

Check out the best prepaid cards of 2024.

Mobile Wallets

Another alternative solution for receiving direct deposit without a bank account is a mobile wallet. These digital wallets allow users to store money and make payments using their smartphone. Some mobile wallets, such as Cash App, PayPal, and Venmo, also offer direct deposit capabilities.

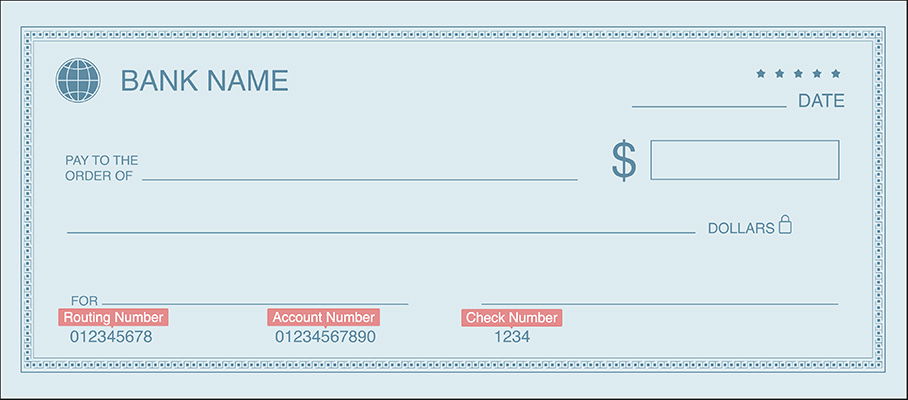

To receive direct deposits through a mobile wallet, you will need to provide your employer or government agency with your mobile wallet’s routing and account number. Once they have this information, they will be able to deposit funds directly into your mobile wallet.

Neobanks

Neobanks are fintech companies that provide cutting-edge apps, software, and technology to make mobile and online banking more efficient. These online-only banks often focus on specific financial products, such as checking and savings accounts.

They typically offer more flexibility and transparency compared to traditional large banks, despite sometimes partnering with them to insure their offerings.

Top 7 Alternatives for Direct Deposit without a Traditional Bank Account

The following are some of the best ways to get a direct deposit without a bank account:

1. Chime®

Chime is a financial technology company that offers a mobile banking app with over 14.5 million downloads. They provide early direct deposit2 for paychecks, no hidden fees, and a savings account with 2.00%3.

With a Chime debit card, you get access to over 60,000 fee-free1 ATMs. You also get fee-free overdraft up to $2005.

The accounts are FDIC insured and offer additional features such as a credit builder plan and alerts for debit card transactions. The Visa Zero Liability Policy also protects your debit card and you can block it if needed.

2. Current

Current is a fintech company and one of the fastest growing mobile banking solutions in the United States, with over one million members.

The mobile banking account offered by Current has many features that set it apart from traditional banks. For example, there are no minimum balance or hidden fees, and account holders can enjoy fee-free overdraft protection of up to $200. Additionally, account holders have access to 40,000 fee-free Allpoint ATMs.

You can also build your credit safely just by swiping your debit card on everyday transactions. No borrowing required, and no credit check involved.

One of the most attractive features of Current is that you can get paid up to two days early with direct deposit. You can also get cashback and earn up to 15x points every time you use your Visa debit card at over 14,000 participating merchants nationwide. There is no minimum opening deposit or monthly maintenance fees required to open a Current account.

3. Cash App

Cash App is a versatile and user-friendly platform that allows you to send and receive money, and buy stocks, or Bitcoin for free. Not only that, but you can also get exclusive discounts when you use Cash App Pay and Cash Card.

Setting up an account is easy and can be done in seconds. You can order a Cash Card and start banking with Cash App right from your phone, and there are no monthly fees or overdraft fees to worry about.

Cash App allows you to receive your paycheck up to two days early with direct deposit. Additionally, if you direct deposit at least $300 each month, you will have any fees instantly reimbursed.

You can withdraw money at any ATM in the world, and you will be fully reimbursed at any in-network ATM. If you have cash on hand, you can deposit it in person at many places near you.

Lastly, Cash Card gives you the security of FDIC-insured balance through their partner banks, which means the federal government promises to protect it. Learn more about how Cash App works.

4. Venmo

With Venmo, you can receive direct deposits up to two days earlier than your normal payday. It’s also free to use and easy to set up, making it a convenient way to manage your money.

Venmo offers a debit card that allows you free access to over 40,000 MoneyPass ATMs. However, there’s a $400 daily withdrawal limit.

In addition to paychecks, you can also use direct deposit for other types of incoming transactions such as side gigs and tax refunds. Plus, your funds are FDIC-insured up to applicable limits for added security.

5. Bluebird by American Express

Bluebird prepaid cards by American Express offer flexibility and convenience for shopping and accessing cash. The cards can be used anywhere American Express is accepted and have access to over 24,000 fee-free ATMs. Additionally, there are minimal fees associated with the card, including no activation fee or monthly fee, and no foreign transaction fees.

Reloading your card is also easy with options such as enrolling in direct deposit, depositing cash at Walmart, or using debit card transfers and mobile check captures. The card also offers user-friendly features such as the ability to have up to four different cards with individual spending limits, and a personal finance management tool called Insights to help track your spending and budget.

6. Brink’s Prepaid Mastercard

The Brink’s Prepaid Mastercard offers a variety of options for adding money to your account, including direct deposit, transferring funds from another account, or visiting one of the 130,000 reload locations. The card also comes with convenient features such as a mobile app, cash back rewards on certain purchases, and the ability to transfer money to family and friends at no cost.

Furthermore, by using the Brink’s card for your tax refund, you may be able to receive your refund sooner. The card account number and routing number can be added during e-file, and the refund will be deposited directly to the card.

7. Netspend Visa Prepaid Card

Netspend is a leading provider of prepaid debit cards, with a quick and easy sign-up process and no credit check or activation fee. The card comes with a free mobile app for easy money management, and can be loaded using the mobile check deposit feature or at one of the 130,000 reload locations.

With the option for direct deposit, users can even get paid up to two days earlier. Two account options are available: Pay-As-You-Go with no monthly fee but $1.50 per transaction, or Premier Plan with a $5 monthly fee but potential savings of up to 50% on fees for direct deposits of at least $500.

Frequently Asked Questions

Can you get direct deposit without a bank account?

Yes, as mentioned above, there are several ways to get direct deposit without a bank account. These include prepaid debit cards, mobile apps, and online banks.

When you fill out the direct deposit form with your employer, just fill in the routing and account number of these direct deposit options instead of checking account information.

How can I get paid if I don’t have a bank account?

There are a few options for getting paid if you don’t have a bank account. One option is to use a prepaid debit card, which can be loaded with funds from a paycheck or other source of income.

Another option is to use a mobile payment service, which allows you to receive and transfer money using a mobile device.

Some businesses may also offer the option to be paid via check or money order, which can be cashed or deposited at a check cashing service. Some companies even offer the option to get paid in Bitcoin or other crypto.

Can I use someone else’s bank account for direct deposit?

Most banks will not authorize a direct deposit if the name on the deposit does not match the account owner’s name. However, some banks may allow it if you have routing number and account number of the recipient.