CashUSA is an online lending marketplace that connects borrowers with a network of personal loan lenders. The platform stands out for its focus on individuals with poor credit scores, making it an excellent option for those who need a loan but may struggle to qualify on other websites.

This comprehensive review of CashUSA will cover everything you need to know about the platform, from the loan options available to the application process and borrower requirements.

What Sets CashUSA Apart

While CashUSA is not a direct lender, as an online loan broker, it collaborates with a diverse network of lenders to provide borrowers with various loan options. This means that borrowers have access to different rates and terms, so it is essential to carefully review loan offers before making a decision. Additionally, the terms of these loans may vary depending on the borrower’s location, as lending laws differ between states.

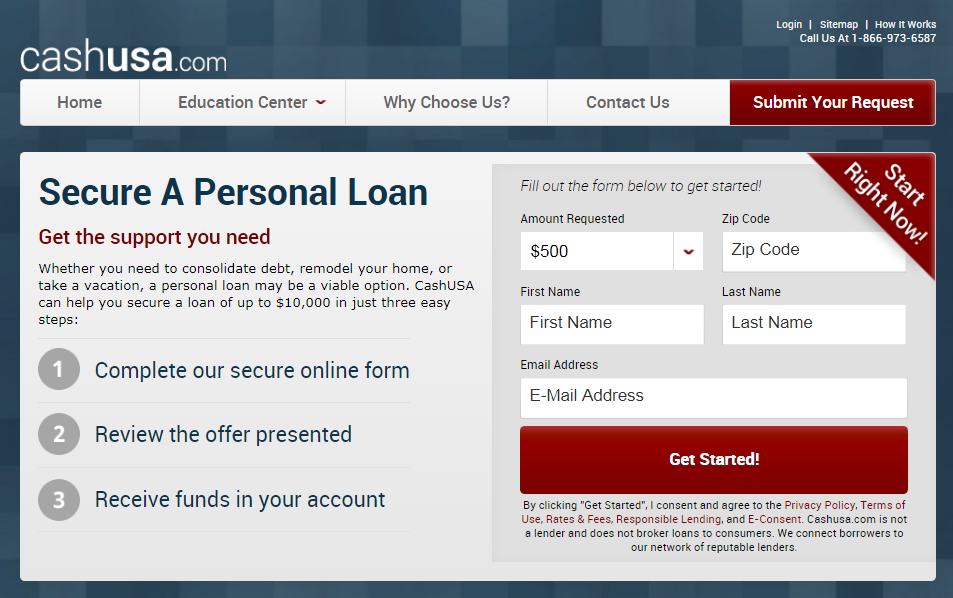

The platform’s application process is designed to be quick and user-friendly, streamlining the experience for borrowers. Read on to learn more about the types of loans available through CashUSA, the qualifications needed to apply, and how the application process works.

Types of Loans Offered by CashUSA

CashUSA.com specializes in unsecured personal loans, with minimum loan amounts of $500 and maximum amounts of $10,000. The specific loan amount a borrower is eligible for depends on their credit score, the lender, and state regulations. These loans can be used for a range of purposes, such as debt consolidation, vacations, or home improvement projects.

Because CashUSA partners with multiple lenders, interest rates can range from 5.99% to 35.99%. While these rates may seem high, they are significantly lower than those of payday loans. Furthermore, loan terms can last between 90 days and 72 months, offering borrowers flexibility in selecting a monthly payment that suits their budget.

All loans facilitated through CashUSA are installment loans, providing borrowers with a predictable payoff date and added peace of mind.

Eligibility Criteria for CashUSA Loans

CashUSA does not enforce a minimum credit score requirement, making it an accessible platform for borrowers of all credit backgrounds, especially those with a bad credit score. To qualify for a loan through CashUSA, borrowers must meet the following criteria:

- Be at least 18 years old.

- Be a U.S. citizen or permanent resident.

- Have a checking account in their name for depositing loan funds.

- Have a stable, after-tax monthly income of at least $1,000.

- Provide three valid pieces of contact information, including an email address, home phone number, and work phone number.

If a borrower meets these basic requirements, they may be eligible for a CashUSA loan and should consider submitting a personal loan request through the platform’s online form.

The CashUSA Application Process

CashUSA’s loan application process is designed to be quick, convenient, and secure. Borrowers can complete the online form in just a few minutes, and upon loan approval, funds may be deposited into their account within one business day.

To expedite the application process, borrowers should have their bank account information, Social Security number, and other personal details readily available. Once loan requests are submitted, CashUSA performs a soft credit pull that does not impact the borrower’s credit score. The platform then searches its lender network for suitable loan offers, directing the borrower to the lender’s website to review the details.

Borrowers can assess loan terms, including monthly payment amounts, before deciding whether to accept a loan offer. There is no obligation to accept the loan, allowing borrowers to carefully consider their options.

If a borrower chooses to accept a loan, they can sign an electronic loan agreement online. Following this, they can expect to receive the loan funds directly into their bank account.

Evaluating Loan Offers

When you receive loan offers through CashUSA, consider the following factors to ensure you’re making the best decision:

- Interest rates: Compare the interest rates of different loan offers to find the most competitive option.

- Loan terms: Consider the loan duration and repayment schedule to determine if it aligns with your financial goals and capabilities.

- Fees and charges: Review any additional fees, such as origination fees, prepayment penalties, or late payment charges, associated with each loan offer.

- Lender reputation: Research the lender’s reputation, including customer reviews and any regulatory actions against them, to ensure you’re working with a trustworthy and reliable company.

Managing Your Loan with CashUSA

Once a borrower’s loan is approved and funded, they can begin to use the money for their intended purpose as soon as it arrives in their bank account. At the same time, they will also need to start making monthly payments directly to their lender.

Repayments are typically made through automatic deductions from the borrower’s account on the designated due date each month. It is crucial for borrowers to ensure they have sufficient funds available to avoid overdraft fees and late payment penalties.

Borrowers should consult their chosen lender to understand their specific policies regarding late payments. If a borrower anticipates not having enough funds available on their due date, they should contact their lender as soon as possible to discuss their options. Always review late fees and the interest rate that you’re offered before accepting a loan offer.

Unique Features of CashUSA

CashUSA offers borrowers several unique features that set it apart from traditional lending platforms:

- Rapid request processing: CashUSA’s streamlined loan request process allows for almost instantaneous review, providing borrowers with faster access to funds compared to traditional banks.

- Secure transactions: CashUSA uses advanced encryption technology and performs daily tests to ensure that borrowers’ personal information remains secure throughout the application process.

- Easy auto-repay function: CashUSA’s auto-repay feature offers borrowers the convenience of automatic monthly payments, eliminating the need to visit physical storefronts or worry about payment delays and associated fees.

- Excellent customer service: CashUSA is committed to providing top-notch customer service, making the platform a convenient and reliable option for securing an online personal loan.

CashUSA Reviews and Reputation

When researching online personal loan providers, it’s important to consider third-party reviews to understand what actual customers have to say about their experiences. While CashUSA currently holds a Better Business Bureau (BBB) rating of F, it has relatively few complaints on the platform. Positive reviews for CashUSA can also be found on other review websites.

Frequently Asked Questions

Is CashUSA legit?

CashUSA is a legitimate platform that can help you find a personal loan. The website partners with a network of reputable direct lenders who offer installment loans with competitive rates and terms.

CashUSA also employs advanced security measures to protect your personal and financial information when you submit your loan request. The website uses industry-standard encryption and data protection protocols to ensure that your data is safe from cyber threats and unauthorized access.

Additionally, CashUSA screens all of its lender partners to ensure that they are licensed, compliant with state and federal regulations, and follow responsible lending practices. By working with CashUSA, you can have peace of mind that you’re getting connected with trustworthy lenders who have your best interests in mind.

Is CashUSA.com safe?

When it comes to borrowing money online, safety and security are paramount concerns. If you are considering using CashUSA.com to obtain a personal loan, you might be wondering, “Is CashUSA.com safe?” The answer is yes.

CashUSA.com provides a state-of-the-art and secure platform for transmitting your loan request to its network of direct lenders. The website employs industry-standard encryption and security protocols to safeguard your personal and financial information. This means that when you submit your loan request, your information is protected and cannot be intercepted by cybercriminals or third parties.

In addition to its website security, CashUSA.com takes extra steps to ensure that all of its direct lender partners are reputable and trustworthy. Before partnering with a lender, CashUSA.com vets them thoroughly, conducting background checks and verifying their licenses and certifications. This helps to weed out any predatory lenders or fraudulent companies and ensures that every loan offer you receive is from a legitimate source.

What can I use a CashUSA loan for?

A CashUSA personal loan offers flexibility, allowing you to use the funds for any purpose, unlike specific loan types that restrict usage. These loans, also known as cash or signature loans, put you in control of how you spend the borrowed money.

Does CashUSA credit your check?

CashUSA itself does not check your credit. However, the lenders within their network might perform a credit check as part of their evaluation process. Soft credit inquiries, which don’t impact your credit score, are often utilized by these lenders to get a preliminary understanding of your creditworthiness. In some cases, a hard credit inquiry may be performed, which can temporarily lower your credit score.

Is CashUSA a payday loan?

CashUSA is not a payday lender. Instead, it connects borrowers with unsecured personal loans. While payday loans are short-term, high-interest loans often used to cover expenses between paychecks, CashUSA’s personal loans offer more flexibility and longer repayment terms.

These installment loans are designed to be repaid through a series of monthly payments, providing a more manageable option for those with credit issues. By not requiring collateral and offering a more extended repayment period, CashUSA loans are a more consumer-friendly payday loan alternative.

Final Thoughts

Before applying for a loan through CashUSA, take the time to carefully assess your financial needs and ensure that you’re making the best possible decision for both your short-term and long-term financial health.

When you receive a loan offer from an online lender within CashUSA’s partner network, compare the interest rates and terms to determine if the loan will save you money in the long run. Additionally, consider how the proposed monthly payment amount compares to your current minimum payments on credit cards or other loans. If the new payment amount is significantly higher, ensure that you can comfortably manage the change in your budget.

CashUSA’s emphasis on accessibility, flexible loan options, and streamlined application process make it an attractive choice for borrowers in need of personal loans, particularly those with bad credit history. By carefully considering your financial situation and the available loan options, you can confidently choose the best loan option for your needs.

Still Searching?

Check out our other personal loan reviews below to continue exploring your options.