If Midland Credit Management has popped up on your credit report, you’re likely dealing with a debt collection account. That can seriously hurt your credit—but it doesn’t have to stay there forever. Here’s how to remove it and protect your score.

What Is Midland Credit Management?

Midland Credit Management, Inc. (MCM) is a debt collection agency based in San Diego, California. It’s a subsidiary of Encore Capital Group, along with Midland Funding, LLC. They’ve been in business since 1953 and specialize in buying old, charged-off debts from creditors.

When MCM shows up on your credit report, it means they purchased a debt you didn’t pay and are now trying to collect it from you.

How Midland Credit Management May Appear on Your Credit Report

You might see any of the following names on your credit report:

- MCM Credit

- Midland Credit

- Midland Collections

- Midland Funding

- Midland Credit Management

- Midland Mgmt

- Midland Fund

- Midland Credit Mgmt Inc

No matter how it’s listed, these entries all point to the same company.

Who Does Midland Credit Management Collect For?

MCM buys debts from a wide range of creditors, including:

- Credit card companies

- Banks and financial institutions

- Retail stores

- Medical providers

- Dental offices

They buy these debts for pennies on the dollar, then try to collect the full amount from consumers.

Is Midland Credit Management Legit?

Yes, Midland Credit Management is a legitimate debt collector. But even legitimate companies make mistakes—and many consumers report issues like:

- Inaccurate information

- Aggressive phone calls

- Trouble verifying the debt

Always verify any debt before agreeing to pay.

How to Remove Midland Credit Management From Your Credit Report

Collections can hurt your credit for up to seven years. But you may be able to get MCM removed sooner. Here are your main options:

1. Dispute Any Errors

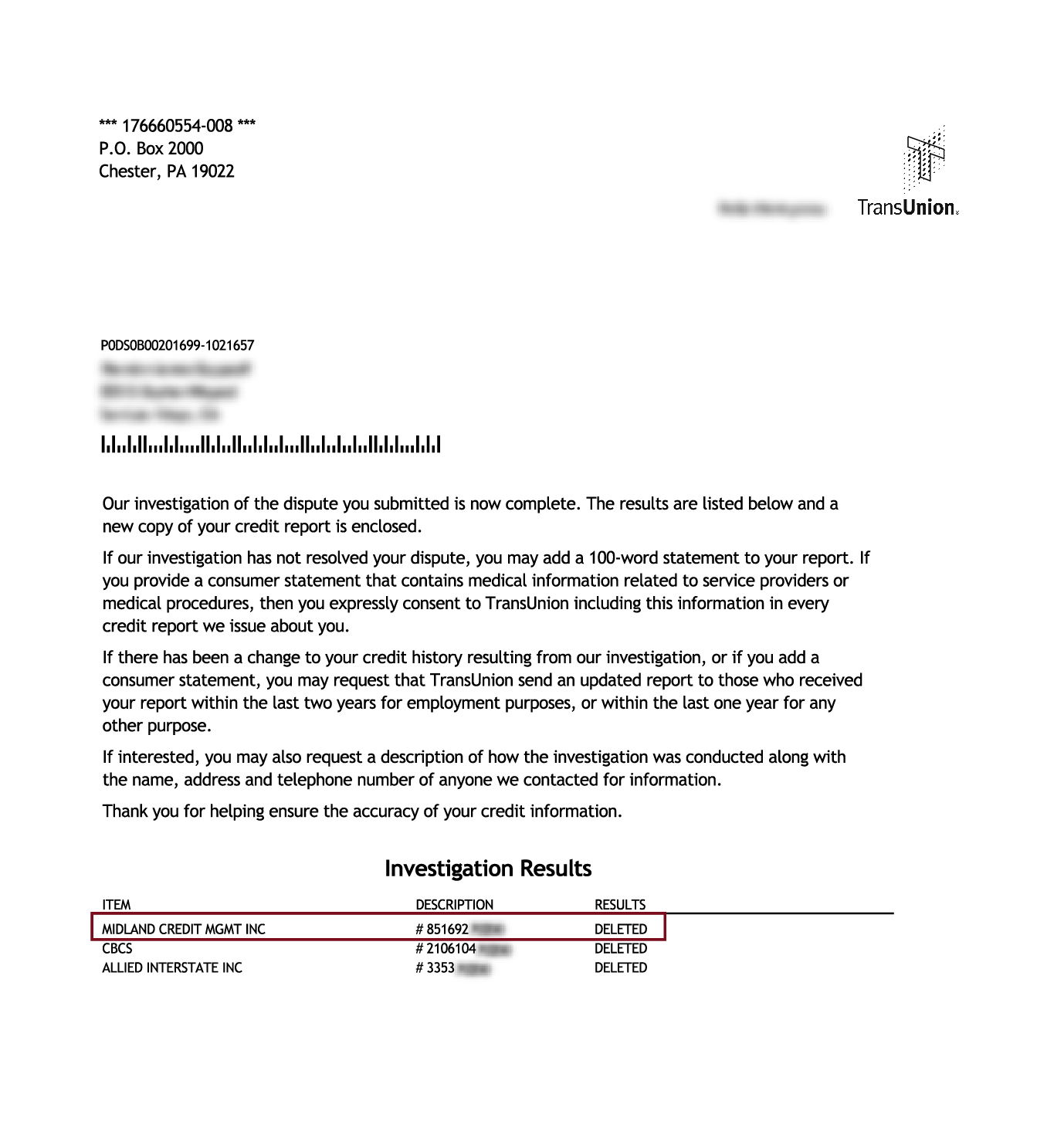

Start by reviewing your credit reports for any inaccurate info tied to the Midland account. If the balance, dates, or account details are wrong, file a dispute with the credit bureaus. They must investigate and fix or remove incorrect items.

2. Request Debt Validation

You can send MCM a debt validation letter asking them to prove the debt is yours. They’re required by law to provide documentation within 30 days. If they can’t, they must stop collection efforts and remove the account from your report.

3. Negotiate a Pay-for-Delete

If the debt is valid, try offering a payment in exchange for them removing the account. This is called a pay-for-delete. While not all agencies agree to this, some do—especially if the account is recent. Always get the agreement in writing.

4. Consider a Credit Repair Company

If you’re not sure how to dispute or negotiate effectively, a credit repair company can step in. They help challenge inaccurate accounts, manage communication, and work to clean up your credit.

Ready to Clean Up Your Credit Report?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.

Should You Contact or Pay Midland Credit Management?

Before making any contact or payment, double-check that the debt is valid and still within your state’s statute of limitations. Paying an old debt can restart the clock and make you legally liable again.

If the debt is new and accurate, resolving it quickly may limit the damage to your credit—but be sure to handle it the right way.

Can Midland Credit Management Sue or Garnish Wages?

Yes, MCM can sue you in civil court to collect on a debt. If they win the case and get a judgment, they could garnish your wages or freeze your bank account—depending on state laws.

That said, lawsuits are costly and usually a last resort. Most collection agencies prefer to work out a payment plan or settlement first.

Common Complaints About Midland Credit Management

Midland Credit Management has thousands of complaints filed with the Consumer Financial Protection Bureau (CFPB) and Better Business Bureau (BBB). Common issues include:

- Reporting inaccurate or outdated information

- Failing to respond to debt validation requests

- Calling excessively or at inappropriate hours

If you feel your rights are being violated, you can file a complaint with the CFPB or your state’s attorney general.

Know Your Rights Under Federal Law

You have protections under the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA). These laws prohibit abusive behavior and give you tools to dispute errors. For example:

- You can request debt validation. MCM must prove the debt is yours.

- They cannot harass you. Repeated calls, threats, or abusive language are illegal.

- They must report accurate information. Inaccurate or incomplete accounts must be corrected or removed.

- They must clearly identify themselves as debt collectors. Both in writing and over the phone.

- They cannot threaten arrest or jail. Unpaid debts are not criminal offenses.

Midland Credit Management Contact Information

Here’s how to get in touch with them if you need to send a letter or request validation:

Address:

Midland Credit Management, Inc.

350 Camino De La Reina, Suite 100

San Diego, CA 92108

Phone Numbers:

(858) 309-6970

(800) 825-8131

(858) 560-2600

Final Thoughts

Midland Credit Management collections can hurt your credit—but they don’t have to stay there. Whether you’re disputing errors, requesting validation, or negotiating removal, you have options to get back on track.

If you’d rather have help, Credit Saint has experience removing negative items like MCM collections from credit reports. They even offer a 90-day money-back guarantee for added peace of mind. Call (855) 281-1510 or visit their website to get started.

Brooke Banks is a personal finance writer specializing in credit, debt, and smart money management. She helps readers understand their rights, build better credit, and make confident financial decisions with clear, practical advice.