If Allied Interstate is showing up on your credit report, it likely means they’re trying to collect a debt you may have forgotten about—or never owed in the first place. Here’s what you need to know and how to deal with them.

What Is Allied Interstate?

Allied Interstate, LLC is a third-party debt collection agency based in Minneapolis, Minnesota. They either collect debts on behalf of original creditors or buy past-due accounts at a discount and try to collect the full amount from consumers.

If you see their name on your credit report, it means a creditor has handed your account over to them, or they’ve purchased the debt and now own it.

Who Hires Allied Interstate?

Allied Interstate collects for major companies across several industries. Some of their known clients include:

- Retailers: J.C. Penney, eBay, Fingerhut

- Telecom providers: DirecTV

- Credit card companies: Capital One, Providian

- Student loan servicers: Sallie Mae

They’re brought in when those companies have had no luck collecting payment directly from consumers.

Is Allied Interstate Legit?

Yes, Allied Interstate is a legitimate debt collection agency. But that doesn’t mean every debt they pursue is valid. Some consumers report frequent calls, texts, or emails—which can make them seem suspicious.

Even if they’re real, you should still verify any debt they claim you owe.

How to Remove Allied Interstate From Your Credit Report

Collection accounts can lower your credit score and stay on your report for up to seven years. Here’s how to deal with Allied Interstate:

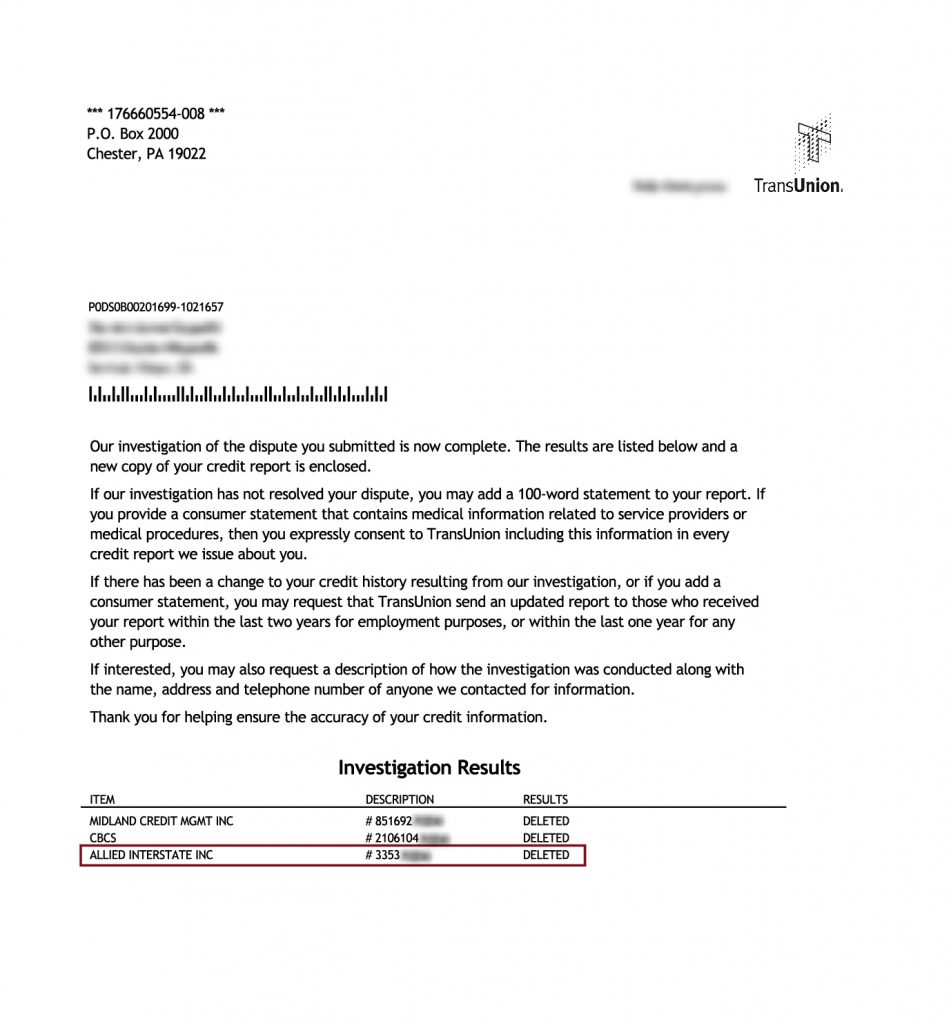

1. Dispute Any Errors

Start by reviewing your credit report. If there’s anything incorrect—wrong balance, dates, or even a debt that’s not yours—you can file a dispute with the credit bureaus.

2. Request Debt Validation

Under the Fair Debt Collection Practices Act (FDCPA), you have the right to ask for proof that the debt is real and belongs to you. Send a written debt validation letter to Allied Interstate within 30 days of their first contact. They must prove:

- The debt is yours

- The amount is correct

- They have the right to collect it

If they can’t validate it, they must stop collection efforts and remove the account from your credit report.

3. Try a Pay-for-Delete Agreement

If the debt is valid, you can offer to settle it in exchange for having the account removed from your credit report. This is called a pay-for-delete. Not all collectors agree to it, but some will—especially if the debt is small or old.

Always get the agreement in writing before sending payment.

4. Work With a Credit Repair Company

If you’re overwhelmed or unsure how to handle it, consider getting help from a reputable credit repair service. These professionals know how to deal with debt collectors and can dispute inaccurate items on your behalf.

Ready to Clean Up Your Credit Report?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.

Should You Contact or Pay Allied Interstate?

Don’t rush to call or pay without confirming that the debt is accurate and legally enforceable. Paying an old debt can restart the statute of limitations in some states, which might give the collector more time to sue you.

Start by requesting debt validation. If the account is legitimate and within the statute of limitations, you can decide whether to pay or negotiate.

Can Allied Interstate Sue You or Garnish Your Wages?

They can—but only if they take you to court and win a judgment. Even then, wage garnishment depends on your state laws. It’s usually a last resort after other collection methods fail.

If you’re served with court papers, don’t ignore them. You’ll want to respond or speak with an attorney right away.

Complaints Against Allied Interstate

Allied Interstate has received many complaints filed with the Consumer Financial Protection Bureau (CFPB) and the Better Business Bureau (BBB). Common issues include:

- Reporting inaccurate information

- Harassing phone calls

- Failure to provide debt validation

You have the right to file a complaint with the CFPB or your state’s attorney general if you feel your rights have been violated.

Your Rights Under Federal Law

You’re protected by two important laws:

- Fair Debt Collection Practices Act (FDCPA) – Limits what debt collectors can say and do.

- Fair Credit Reporting Act (FCRA) – Gives you the right to dispute inaccurate credit report information.

Here’s what Allied Interstate cannot legally do:

- Report false or incomplete details about your debt

- Call repeatedly or use abusive language

- Threaten legal action or arrest without cause

- Lie about who they are or why they’re contacting you

- Refuse to validate a debt when you ask in writing

Contact Information for Allied Interstate, LLC

Office Address:

Allied Interstate, LLC

12755 Highway 55, Suite 300

Minneapolis, MN 55441-4676

Mailing Address:

P.O. Box 19312

Minneapolis, MN 55419

Phone: (800) 811-4214

Need Help Removing Allied Interstate From Your Credit Report?

If Allied Interstate is hurting your credit score, it might be time to bring in the pros. Credit Saint has years of experience removing inaccurate collections, late payments, and charge-offs from credit reports.

They’ve helped thousands of people take control of their credit—and they back it up with a 90-day money-back guarantee.

Call them at (855) 281-1510 or visit their website to schedule a free consultation and get started today.

Brooke Banks is a personal finance writer specializing in credit, debt, and smart money management. She helps readers understand their rights, build better credit, and make confident financial decisions with clear, practical advice.