If Alliance One is showing up on your credit report, there’s a good chance you have an unpaid debt that’s been sent to collections. This can lower your credit score and make it harder to qualify for loans, housing, or even a job. But you’re not stuck with it—there are steps you can take to potentially remove Alliance One from your credit report.

Why Alliance One Is on Your Credit Report

AllianceOne Receivables Management, Inc. is a debt collection agency based in Trevose, Pennsylvania. When companies can’t collect payment from customers, they often turn the account over to agencies like Alliance One to recover the money.

If Alliance One is listed as a collection account, it means they’re trying to collect a debt they believe you owe. It could be from a credit card, medical bill, utility company, or even a government or education-related debt.

Once a debt hits collections, it gets reported to the credit bureaus and can damage your credit for up to seven years if you don’t take action.

Who Alliance One Collects For

Alliance One works with a wide range of creditors across industries, including:

- Government and educational institutions

- Credit card issuers

- Medical and healthcare providers

- Utility and telecommunications companies

These organizations hire agencies like Alliance One to recover unpaid bills, which can then be reported to the credit bureaus if left unresolved.

Is Alliance One a Legitimate Company?

Yes, Alliance One is a legitimate debt collector. They’ve been in business since 1998 and are authorized to collect on behalf of other companies. However, just because they’re legitimate doesn’t mean you shouldn’t verify the debt or know your rights—collection agencies often make mistakes or fail to provide proper documentation.

How to Remove Alliance One From Your Credit Report

Collection accounts can seriously damage your credit score, but there are several ways to get them removed:

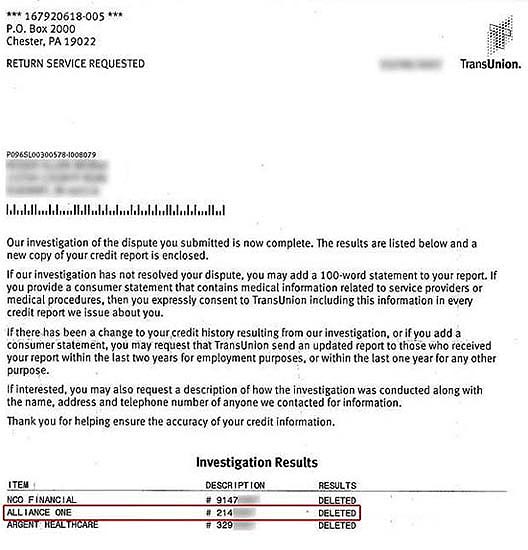

1. Check for Errors and Dispute Inaccurate Information

Start by reviewing your credit report. If anything looks off—such as the balance, account dates, or whether the debt is even yours—you can file a dispute with the credit bureaus. They have 30 days to verify the information. If they can’t, the account must be deleted.

2. Request Debt Validation

You also have the right to ask Alliance One for proof that the debt is valid. This is called a debt validation letter. They must respond within 30 days with evidence that the debt belongs to you and that the amount is correct. If they fail to validate, they cannot continue reporting the debt.

3. Offer a Pay-for-Delete Agreement

If the debt is valid, and you can afford to pay it, ask Alliance One if they’re willing to delete the account in exchange for payment. This is known as a pay-for-delete. Not every collector will agree, but some will—especially if the debt is small or old. Always get the agreement in writing before you pay.

4. Work With a Credit Repair Professional

If you’re not comfortable dealing with collection agencies on your own, consider working with a credit repair company. Professionals can handle disputes, communicate with collectors, and help remove inaccurate or outdated negative items from your credit report.

Ready to Clean Up Your Credit Report?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.

Should You Contact or Pay Alliance One?

Before you call or pay Alliance One, make sure the debt is:

- Legitimate – Check that the debt is actually yours and reported correctly.

- Within the statute of limitations – In some states, old debts may be uncollectible.

- Worth paying – Paying a debt could restart the clock on how long it stays on your report.

If you’re unsure, get help from a credit expert or consumer attorney before moving forward.

Can Alliance One Sue You or Garnish Your Wages?

Yes, Alliance One can take legal action to collect a debt. If they file a lawsuit and win, they could get a court judgment that allows them to:

- Garnish your wages

- Levy your bank account

- Place a lien on your property

That said, lawsuits and garnishments are usually a last resort. Before they sue, they must notify you and prove the debt is valid. If you’re sued, respond right away and consider speaking with a lawyer.

Common Complaints About Alliance One

Many complaints about Alliance One involve:

- Inaccurate reporting

- Failure to verify debts

- Repeated or harassing phone calls

If you’re being harassed, or they won’t validate the debt, you can file a complaint with:

- The Consumer Financial Protection Bureau (CFPB)

- The Better Business Bureau (BBB)

- Your state attorney general’s office

Your Rights Under the FDCPA and FCRA

You have powerful rights when dealing with debt collectors, thanks to two federal laws:

- Fair Debt Collection Practices Act (FDCPA)

- Fair Credit Reporting Act (FCRA)

These laws protect you from abusive tactics and give you tools to fix errors on your credit report. Under these laws:

- Alliance One must stop contacting you if you ask in writing.

- They can’t lie, threaten, or harass you.

- They must send a written notice of the debt and identify themselves as a collector.

- You can demand debt validation to prove the account is real.

- You can dispute inaccurate information and request that it be removed.

Alliance One Contact Information

Headquarters Address:

AllianceOne Receivables Management, Inc.

4850 E. Street Road, Suite 300

Trevose, PA 19053

Mailing Address:

PO Box 3100

Southeastern, PA 19398-3100

Phone Numbers:

(800) 858-4472 or (215) 354-5511

Want Help Getting Alliance One Removed?

If you’re dealing with Alliance One on your credit report and don’t want to handle it alone, a credit repair company can step in. Credit Saint has helped thousands of people remove collection accounts and improve their credit—and they offer a 90-day money-back guarantee if they don’t deliver.

Visit their website or call (855) 281-1510 to learn more about your options.

Brooke Banks is a personal finance writer specializing in credit, debt, and smart money management. She helps readers understand their rights, build better credit, and make confident financial decisions with clear, practical advice.