If Afni Collections has appeared on your credit report, it usually means you have an unpaid bill that’s been sent to collections. This kind of account can hurt your credit score and stay on your report for up to seven years—but there are steps you can take to get it removed.

Here’s how to deal with Afni and protect your credit.

Why Afni Collections Is on Your Credit Report

Afni Collections is a debt collection agency and a subsidiary of Anderson Financial Network, Inc. They’re based in Bloomington, Illinois, and work on behalf of other companies to collect unpaid debts.

When a company can’t collect from a customer, they may assign or sell the debt to Afni. From there, Afni will attempt to collect—often through letters, phone calls, or credit reporting.

If you see Afni listed on your credit report, it could appear under names like:

- afni bloomington il

- afni collections at&t

- afni com

- afni bloom collections

- afni inc collections

- afni peoria il

Who Afni Collections Works With

Afni is known to collect for major companies across several industries. This includes:

- Telecommunications providers like Verizon, Sprint, T-Mobile, and Comcast

- Credit card issuers

- Healthcare organizations

If you missed a payment with one of these companies, Afni may be the agency attempting to collect.

Is Afni Collections Legit?

Yes, Afni is a legitimate debt collection company. They’ve been in business for years and are licensed to operate in the U.S. That said, their tactics can sometimes feel aggressive, especially if they’re calling frequently or sending repeated messages.

Even if they are legitimate, you still have rights—and you shouldn’t assume every collection claim is accurate.

How to Remove Afni Collections From Your Credit Report

A collections account can seriously damage your credit, so it’s important to deal with it as soon as possible. Here are the most effective ways to get Afni removed from your credit report.

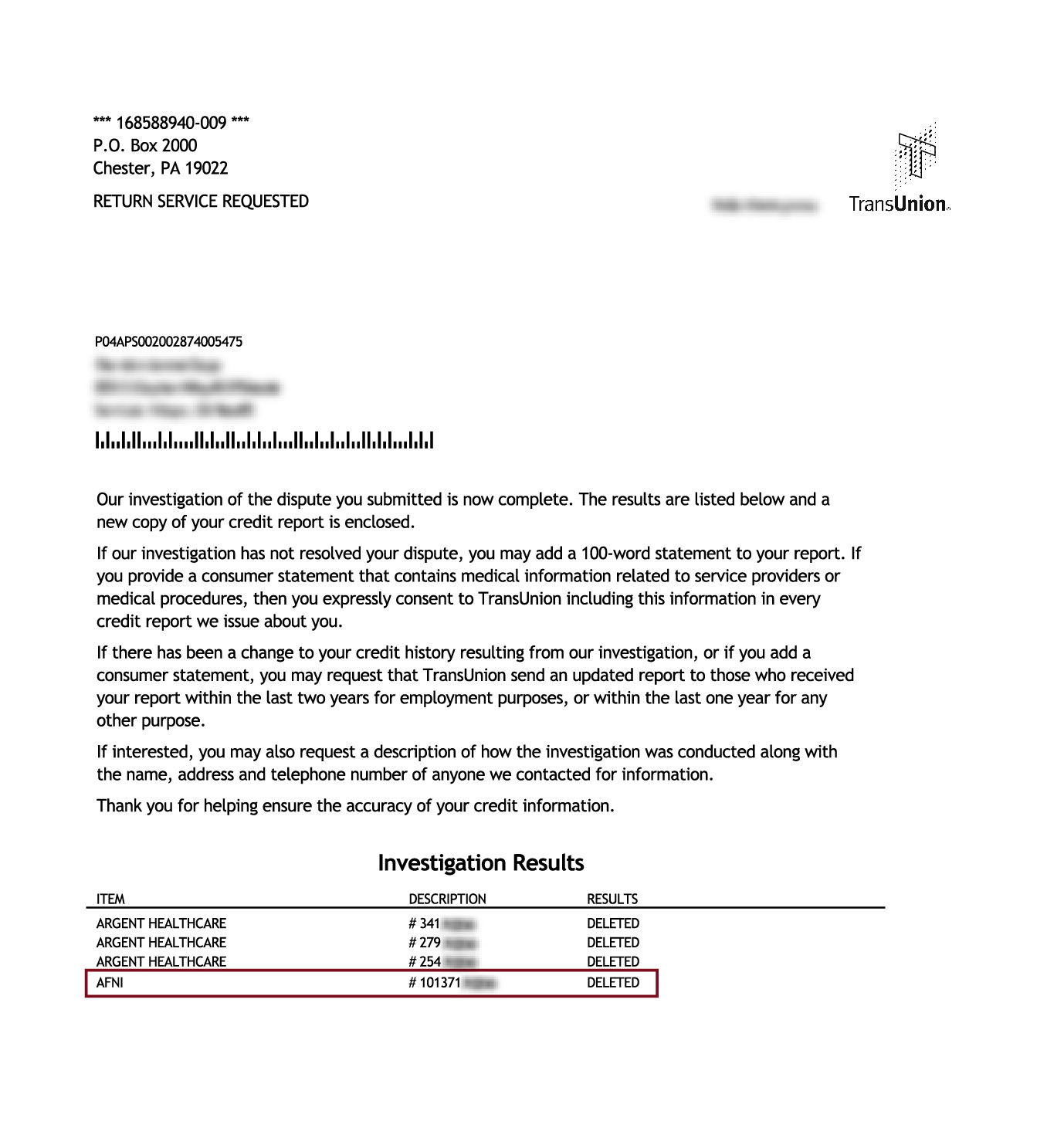

1. Dispute Any Inaccurate Information

Check your credit report for errors. If anything looks off—like the balance, account number, or ownership—you can dispute it with the credit bureaus. If Afni can’t verify the debt, it must be removed.

2. Request Debt Validation

You also have the right to ask Afni for proof that the debt is actually yours. This is called a debt validation letter. If you send your request within 30 days of first contact, Afni is required to show documentation that confirms the debt and the amount. If they can’t, they must stop reporting it.

3. Negotiate a Pay-for-Delete

If the debt is valid, consider offering to pay in exchange for deletion. This is known as a pay-for-delete agreement. Not all agencies agree to this, but some will. If they accept, make sure to get the agreement in writing before making any payments.

4. Work With a Credit Repair Professional

If you’re not comfortable handling it yourself, a reputable credit repair company can help. They can review your credit report, dispute incorrect information, and communicate with Afni on your behalf to get negative entries removed.

Ready to Clean Up Your Credit Report?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.

Should You Contact or Pay Afni?

Before contacting Afni, take these steps:

- Verify the debt is legitimate

- Confirm the amount is accurate

- Check the age of the debt

- Know the statute of limitations in your state

Be aware that making a payment can reset the clock on how long the debt remains active. If you’re unsure, seek guidance before responding or paying.

Can Afni Collections Sue or Garnish Wages?

Afni has the legal right to sue you for unpaid debt. If they take you to court and win, they could obtain a judgment that allows them to:

- Garnish your wages

- Freeze your bank account

- Place a lien on your property

However, this process requires them to prove the debt is valid, and it typically only happens after other attempts to collect have failed. Wage garnishment also depends on your state’s laws, and not all states allow it for consumer debt.

Common Complaints About Afni Collections

Afni, like many debt collectors, has had complaints filed with the Consumer Financial Protection Bureau (CFPB) and the Better Business Bureau (BBB). Common issues include:

- Inaccurate reporting

- Failing to verify debts

- Repeated or harassing calls

If you’re being harassed or the debt seems questionable, you can file a complaint with the CFPB or your state’s attorney general.

Your Rights Under the FDCPA and FCRA

You are protected by two key federal laws:

- The Fair Debt Collection Practices Act (FDCPA)

- The Fair Credit Reporting Act (FCRA)

These laws give you important rights when dealing with Afni:

- You can request written proof of the debt

- You can dispute any information you believe is inaccurate

- Afni cannot threaten, harass, or mislead you

- They must identify themselves as debt collectors in writing and on calls

- They cannot threaten arrest or jail over unpaid debts

Knowing your rights helps you push back against any unfair or illegal behavior.

Afni Collections Contact Information

Office Address

Afni Collections

404 Brock Dr

Bloomington, IL 61701

Mailing Address

PO Box 3097

Bloomington, IL 61702-3427

Phone Number

(866) 352-0479

Note: It’s best to communicate with debt collectors by mail. Avoid discussing your debt over the phone unless you’re working with a professional or legal representative.

Want Help Getting Afni Off Your Credit Report?

If Afni is dragging down your credit score, you’re not alone. Many people find it easier and faster to work with a credit repair company that knows how to challenge these accounts and push for removal.

Credit Saint has helped thousands of people deal with collection agencies like Afni and clean up their credit reports—and they back their service with a 90-day money-back guarantee if they don’t deliver.

To see if they can help you, visit their website or call (855) 281-1510 for a free consultation.

Brooke Banks is a personal finance writer specializing in credit, debt, and smart money management. She helps readers understand their rights, build better credit, and make confident financial decisions with clear, practical advice.